Renegade Economist’s “Four Horsemen” documentary lifts the lid on how the world really works. “Four Horsemen is a breathtakingly composed jeremiad against the folly of Neo-classical economics and the threats it represents to all we should hold dear.” Free from mainstream media propaganda — the film doesn’t bash bankers, criticize politicians or get involved in conspiracy theories. It ignites the debate about how to usher a new economic paradigm into the world which would dramatically improve the quality of life for billions. Since it is becoming abundantly clear that we will never return to ‘business as usual’, 23 international thinkers, government advisers and Wall Street money-men break their silence and explain how to establish a moral and just society.

Archives of “Film” tag

rssThe 10 Alarming Things in Trading

I was reading this article and started thinking about the ten scariest things in trading: The Top Ten Things That Make Horror Movies Scary.

1. Fear of Death. This is the ultimate fear, both existentially and psychologically. It isn’t really a horror movie if people don’t get killed.

In Trading: fear of depletion of assets.

2. The Dark. From our earliest childhood we are afraid of the dark – not the dark itself, but what it hides. It makes horror movies even scarier to watch them in a darkened theater, or a dark living room, right?

In Trading: not knowing enough news

3. Creepy, Crawly Things. Snakes, spiders, rats, and other crawling things are scary in and of themselves, but when they touch the skin, in the dark, it amplifies this common phobia.

In Trading: monthly expenses

4. Scary Places. Horror movies are full of scary places – graveyards, old houses, overgrown forests, dungeons, attics, basements. These are dark places, where evil things can hide. (more…)

WallStreet Movies and S&P 500 :Great Correlation

If you had gotten out of the market when these movies were released, you’d definitely have missed some big moves…to the upside. Wall Street came out after the crash of ’87 in December 1987, and taking money off the table for the multi-year bull market that followed would have been a big miss. Boiler Room came out just a month before the peak in 2000, so in this case it was a good sell signal.

The sequel to the original Wall Street, Money Never Sleeps came out during a leg down in the current bull market in 2010, and its placement in the upper chart is a bit misleading. Yes, filming for the movie began in late 2009, but the market bottomed in early 2009. Whether you use the dates they began filming or the release date, Money Never Sleeps did not coincide with a peak for the equity market, and in retrospect was a great time to get in. As for the Wolf of Wall Street? Only time will tell, but keep in mind that unlike the other movies, it is not intended to be set in present day, instead romanticizing the heady days of the 1990s. (more…)

THE VERY SUCCESSFUL TRADERS

The very successful traders I’ve known are very aggressive. When they’re right, they press their advantage. They add to good positions or keep re-entering in the direction of their idea as long as nothing is proving them wrong. “No one ever went broke taking a profit” is not how the best traders operate. What Dr. Kiev was saying was get out of losing ideas quickly, but really milk the winners. A good trade is valid until proven wrong. Just a few more big winners make a big performance difference by the end of a year. Risk management is not just cutting losers short; it’s also ensuring that the average size of your winners handily outstrips that of the losers.

The very successful traders I’ve known are very aggressive. When they’re right, they press their advantage. They add to good positions or keep re-entering in the direction of their idea as long as nothing is proving them wrong. “No one ever went broke taking a profit” is not how the best traders operate. What Dr. Kiev was saying was get out of losing ideas quickly, but really milk the winners. A good trade is valid until proven wrong. Just a few more big winners make a big performance difference by the end of a year. Risk management is not just cutting losers short; it’s also ensuring that the average size of your winners handily outstrips that of the losers.

The Education of a Speculator – Victor Niederhoffer (Quotes )

The negatives are that the book is a very tough read with unconventional style of writing, perhaps way over most people heads, and you need some background on how markets work. However, you can feel that he has a lot of energy, wisdom/knowledge and is very competitive. He focuses on his mistakes (this was before his blowup), his upbringing, victories and moments of elation.

I always mark possible quotations when reading a book. This book is so full of them! Here are some random excerpts:

- “Risk taking…is positively correlated with how well we feel about ourselves.” (page 113)

- “One thing is for sure. Among the emotionally charged, you will not find one single long-term winner. Where are they? According to Bacon: “These quiet professionals are quite inconspicuous unless you look for them, because there are so many careless gamblers, crazy amateurs, jumping from one crackpot idea to another betting on hope and fear”. I show this passage to any trader in my office who is showing color or palpitation.” (206)

- I find that Chinese handball has much to teach me about market practices. A limit order is a good tactic for Chinese trading, but a market order works best for handball trading. The direct market order against a quickly moving target frequently leads to a fast rebound against. The game is then over before it starts….I use limits orders. I don’t win fast, but the losses are a lot slower in coming.” (397)

- “…chain smoking, temper tantrums, screaming…these expressions of emotion have within them the seeds of destruction. I enforce a ban against all jocularity and temper tantrums.” (207)

- “Offering advice without expertise is aggressive ignorance.” (188)

- “With the increasing specialization in modern times, born losers are commonplace.” (85)

- “During the 10 years I traded for George Soros, I never heard him speak about a winning trade. To hear him talk, you’d think he had nothing but losers. Conversely, listening to the biggest losers, you’d think they had nothing but winners.” (95)

- “Do not follow the mentally lazy habit of allowing a newspaper or a broker or a wise friend to do our security market thinking.” (114)

- “The best opportunities come out of the clear blue.” (129)

- “The exchange is a market ecosystem.” (353)

- “Oracles, forecasts, and prophecies are a business. They should be evaluated with the same skepticism and savvy that would be applied to a used-car dealership.” (64)

- “The only newspaper I read is the National Enquirer. I don’t own a television, don’t follow the news, don’t talk to anyone during the trading day, and don’t like to read books less than 100 years old.” (ix – preface)

- “My resistance to conformity has been the bedrock of my speculative persona.” (110)

- “…institutional learning, like the Harvard Colleges and Lincoln High Schools of Life – the kind that prepares most of us to become good soldiers, true believers, and conformists.” (110)

- “An incapability of relying on oneself and faith in others are precisely the conditions that compel brutes to live in herds.” A quote from Niederhoffer’s intellectual hero, Francis Galton (136)

They are endless! If you are just to by one trading book, this is it. Enjoy!

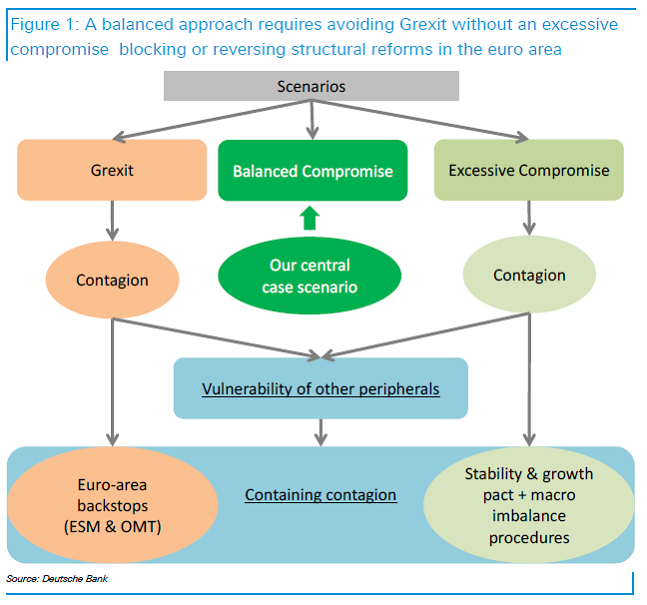

The “Greek Issue”-Fascinating flowchart

It is wrong to think that contagion stems only from Grexit. An excessive compromise with Greece could result in moral hazard, particularly in relation to structural reforms. This could undermine the medium-term stability of the euro area. The tail risk is that Greek politicians try to leverage too much the fear of Grexit “contagion risk”. We complete our analysis by looking at the vulnerability of other euro peripherals and the ex-post tools to limit contagion.

10 Favorite Quotes from Reminiscences of a Stock Operator

- There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.

- The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among professionals.

- I never lose my temper over the stock market. I never argue the tape. Getting sore at the market doesn’t get you anywhere.

- They say you can never go poor taking profits. No, you don’t. But neither do you grow rich taking a four-point profit in a bull market. Where I should have made twenty thousand I made two thousand. That was what my conservatism did for me.

- Remember that stocks are never too high for you to begin buying or too low to begin selling.

- A man may see straight and clearly and yet become impatient or doubtful when the market takes its time about doing as he figured it must do. That is why so many men in Wall Street…nevertheless lose money. The market does not beat them. They beat themselves, because though they have brains they cannot sit tight.

- After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was the sitting. Got that? My sitting tight!

- Losing money is the least of my troubles. A loss never bothers me after I take it…But being wrong—not taking the loss—that is what does the damage to the pocketbook and to the soul.

- Prices, like everything else, move along the line of least resistance. They will do whatever comes easiest.

- The speculator’s chief enemies are always boring from within. It is inseparable from human nature to hope and to fear. In speculation when the market goes against you hope that every day will be the last day—and you lose more than you should had you not listened to hope—the same ally that is so potent a success-bringer to empire builders and pioneers, big and little. And when the market goes your way you become fearful that the next day will take away your profit, and you get out—too soon. Fear keeps you from making as much money as you ought to. The successful trader has to fight these two deep-seated instincts…Instead of hoping he must fear; instead of fearing he must hope.