Dissolve stakes in Boeing, Facebook and others

The Saudi public investment fund has exited positions in a slew of major companies stocks including:

- Starbucks

- Citigroup

- Bank of America

- Pfizer

- Boeing

- Disney and

- BP

The Saudi public investment fund has exited positions in a slew of major companies stocks including:

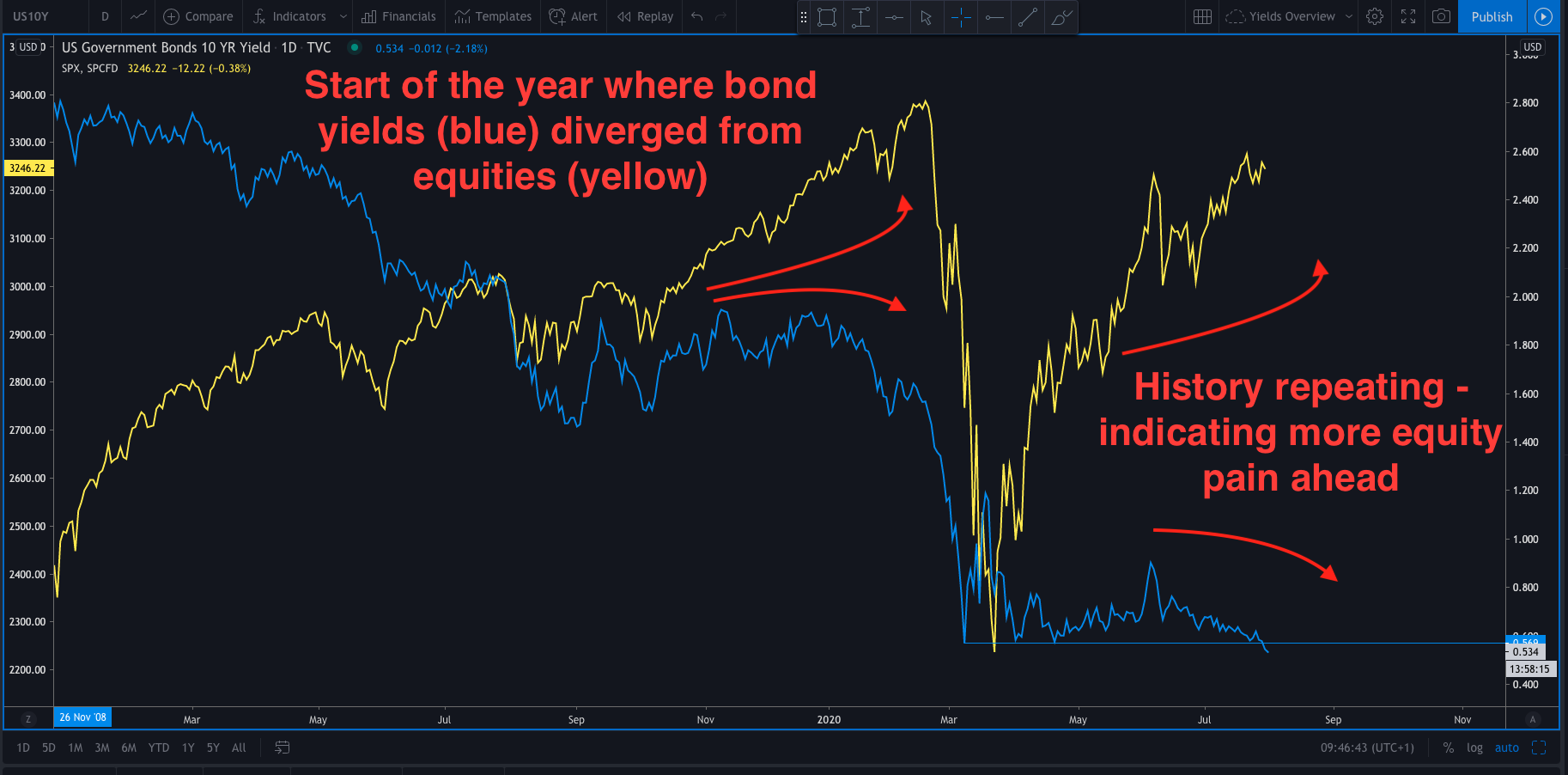

The constant fall in Bond yields is sending out a signal that all is not well in the world. The tail end of last week may have seen some excellent earnings from facebook, apple, amazon and alphabet and that started a fresh equity rally early Friday. However, the fall of Bond yields is saying, ‘look out! There may be trouble ahead. For the uninitiated bond traders tend to take a more long tern macro view. So, when equities rise, but bond yields are falling that is a signal something is wrong.

If you can recall at the start of the year one of the big questions was which market is right? Falling and yields or rising equities? The answer has been, ‘the falling bond yield market’. So, the general rule of thumb is go with the bond yield market. Now, of course this doesn’t mean that a funny divergence can last for weeks and months. However, at the very least it is a warning sign. That warning sign is showing again.

Yields are dropping

The 10Y Gilt yield (UK bond) hit a record low last week. The 10Y Bund (German bond) closed at its lowest level since mid-May on Thursday last week, while the 10 y UST (US bond) was down towards its lowest ever close last week too.

Why are they dropping?

The proverbial tea leaves are being read and a second wave of COVID-19 is being seen ahead. This will mean more monetary and fiscal policy help to get through the pandemic.So, yes the equity market has been rallying on the central bank support. However, the bond market is saying that the next stage of the global economy is fraught with dangers and a ‘V’ shaped recovery is more hope than reality.

the month of July is over and all the major indices closed higher for the 4th consecutive month. The S&P index had its second-best July performance since 2010. Apple, Amazon, Facebook all of the way after their earnings release last night. Apple rose up 10.47%. Facebook rose 8.18% and Amazon rose by 3.7%. Alphabet was left out despite posting better earnings. Their stock fell by -3.28%.

The major indices close mixed ahead of the key earnings from Apple, Amazon, alphabet and Facebook

Facebook’s CEO Mark Zuckerberg:

“I want to stress the importance of being young and technical. Young people are just smarter. Why are most chess masters under 30? I don’t know. Young people just have simpler lives. We may not own a car. We may not have family. Simplicity in life allows you to focus on what’s important.”

Of course, family, and other aspects of life are important, but that doesn’t take away from Zuckerberg’s wisdom. Want to make something big happen, like trend following success, then avoid distraction. Period.

Facebook CEO Mark Zuckerberg said it was almost guaranteed that Facebook would hit 1 billion users last month. But with developed countries largely tapped and the social network’s growth slowing in both raw and percentage terms this spring, the company is eyeing emerging markets as a new source of users.

When you get to around 500 million users, much of the low-hanging fruit has already been picked. So where to next? To learn about how the company is adapting to foreign markets to capture its next 500 million, we talked with Javier Olivan, the company’s head of international growth. He joined the company three years ago when it had less than 40 million users.

One major prong of the expansion effort depends on the company’s mobile team, which is securing deals left and right for 0.facebook.com, a free, low-bandwidth version of the site for feature phones. Olivan said operators were carrying the expense of free data access for users, not Facebook. The company also signed two major deals in the last week with Bharti Airtel in India and Beeline and MTS in Russia to provide free mobile access for users. They add to similar deals with at least 50 operators around the world that will help bring in millions of mobile users in developing countries.

Facebook’s recent acquisition of Malaysian contact importing company Octazen Solutions will also feed into its growth strategy as there’s a long tail of e-mail services used in foreign markets that can be difficult to tap into piece by piece, he said.

Right now, Southeast Asia is leading the way in terms of Facebook’s fastest-growing countries, with Indonesia and India up front. The company holds the top position in several Asian markets with the exception of Japan, South Korea, India, Taiwan and China, where the service is largely blocked, according to Comscore.

Here’s what Facebook is up to in various markets:

Japan: Japan is one of the rare developed-country markets where Facebook lags behind the pack. Competitor and blogging platform Mixi boasts 20 million users, while Twitter receives 16 million unique visitors per month. Facebook, in contrast, has just an estimated 1.2 million users in the country.

Olivan said the company has sent some of its best engineers to Tokyo to develop a version of the software that works for the market, which has a distinct mobile phone culture. One key problem was getting the mobile web site version of Facebook right. While U.S. users tend to reach the site through apps, most Japanese users try to reach Facebook through either the feature phone or touch-optimized web sites.

“If you look at the product eight months ago, it was unusable,” Olivan said. Part of the problem was that many Japanese phones don’t recognize cookies, making it difficult to keep a user logged in through the service.

India: Facebook, with 10.5 million users and growing, is closing in on Google’s Orkut, which has seen its traffic stagnate. The company is gearing up to open its first large office in India and closed the Bharti Airtel deal on Monday.

Olivan said the company made lots of subtle, “under the hood” fixes to attract users in the country away from competing social networks. They compiled a comprehensive database of all of the high schools in India to prepopulate a list when users sign-up for the service so they can easily find their friends. (more…)

![]()

Diane Sawyer on ABC on July 21 interviewed Facebook’s CEO and Founder Mark Zuckerberg. She spoke with him about Facebook hitting 500 million members (third largest country in the world), plans to go public, the recent contract dispute with Paul Ceglia claiming he owns 84% of Facebook (which Zuckerberg calls BS), the new movie which he calls “fiction” and reflections on Harvard. He also answers viewer questions. Dude is on top of the world at 26. Below is a 6 minute interview clip and links to more footage from the interview.

Based on what the big investors (like Microsoft) have been willing to pay to own a piece of the company, Facebook now has a valuation of about $23 billion.