- You can have virtually anything you want, but you can’t have everything you want.

- Life is like a giant smorgasbord of more delicious alternatives than you can ever hope to taste. So you have to reject having some things you want in order to get other things you want more.

- Some people fail at this point, afraid to reject a good alternative for fear that the loss will deprive them of some essential ingredient to their personal happiness. As a result, they pursue too many goals at the same time, achieving few or none of them.

- In other words, you can have an enormous amount: much, much more than what you need to have for a happy life. So don’t get discouraged by not being able to have everything you want, and for God’s sake, don’t be paralyzed by the choices. That’s nonsensical and unproductive. Get on with making your choices.

Archives of “Emperor Muzong of Tang” tag

rssSelling Out at a Good Price and Re-Entering at a Worse Price

- Reasons

- You think that the price is going down, so you sell at $X. Price drops below $X, you feel good that you sold out earlier, then you shift your attention to other things. Now and then you check the price again, and saw that it kept going lower, so you still feel good. Then after a while you start to notice that the price is inching back to $X, so you start to think ‘hmm.. look’s like it’s going back up, maybe I shouldn’t have sold. Let’s monitor this for a while, see what happens’. Your ‘Fear of Missing Out’ and your ‘Fear of Future Regret’ is starting to grow.

- All the while, you had no concrete action plan on how you would handle this, you have not decided at what price or point you would go back in, or would you cut this position out entirely. Without a trading plan decided beforehand, you are bound to react to your emotions.

- Soon, the price moves above $X, and keeps moving up. Finally, you can’t take it anymore, you re-enter your position at a price higher than $X. That helped to ‘quieten’ your ‘Fear of Missing Out’.

- Then as it usually happens, price goes back down again, drops below $X and goes down further. Either your fear of taking a loss kicks in and you stick with a losing position, or you sell out at a loss.

- Solutions

- You have to decide beforehand, even before you exit the position, how you would handle the position. To do that, you need to be clear on the reason why you are selling in the first place.

- If you are selling because you think that the uptrend has changed to a downtrend, or the uptrend is broken, you would need to have specific criteria that you look for to know whether the uptrend has resumed. If the criteria has not been met, even if the price goes above $X, you will not re-enter your position.

- If you are selling because you think the uptrend is still intact but there will be a short momentum reversal, you need to get out and get back in very quickly, usually just catching 1-2 ticks more. This type of play where you react to momentum is highly discouraged. The risk-reward is bad, the skill level, reaction speed, concentration required are extremely high, and it makes you susceptible to falling into the trap of ignoring the bigger market structure.

- You have to realize that you are playing into the hands of the usual fighting that goes between bulls and bears when you keep reacting to the swings, which will naturally make you buy high and sell low.

- In conclusion, you need to be very clear of reason that you are selling. In that way, you would be clear of when, if ever, you would re-enter the position.

EU proposes €750 billion pandemic stimulus fund

Including €390 billion in grants

the EU is proposing a €750 billion stimulus fund. The grants within that fund are proposed at €390 billion. This is lower than the €500 billion that Germany and France propose, but is higher than the €350 billion billion counterproposal from the so-called frugal countries.

- You proposes €1.074 trillion for blocks 2021 – 2027 budget

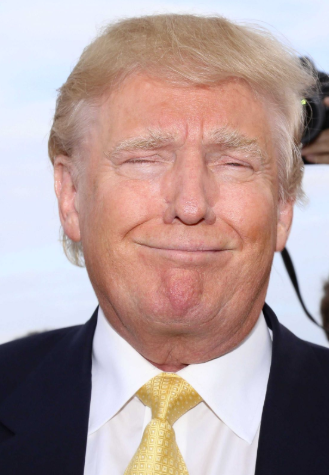

Trump says he is not interested in speaking with China on another trade deal

Whiny biatch speaking in a CBS interview Sry, damn autocorrect. Trump speaking in a CBS interview.

So far he has been whining about getting schools reopened and various grievances he has with life.

Comment on China the only one really pertaining to markets, so far at least.

More from Trump:

- We can impose massive tariffs on China f we want

- You’ll see more coming on actions towards China

- China is buying a lot of agricultural products