…Stocks are not liking the optics of it all

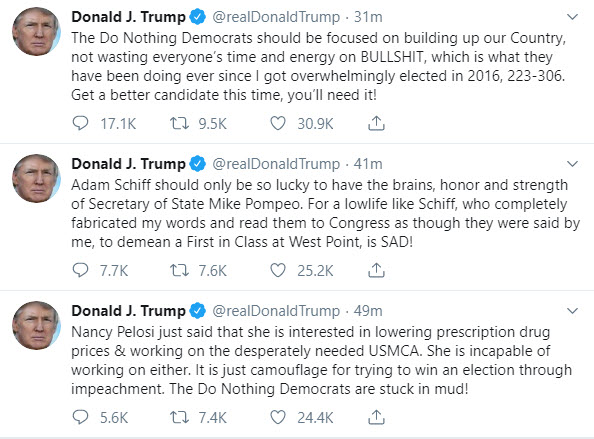

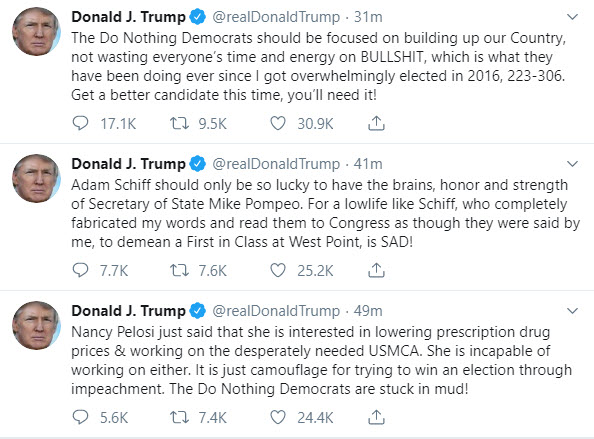

Pres. Trump is sounding off as he defends himself in the way he knows how. Below are a sampling of the recent tweets:

He is also on the wires saying:

- He thinks the whistleblower should be protected if he is a legitimate whistleblower

But adds:

- Person who provided whistleblower information is a spy

What does it have to do with the market?

Stocks continue to suffer, as things are seemingly more and more in disarray.

The S&P is currently down 56 points or -1.9% at 2884.30. The NASDAQ is down 142 points or -1.8% at 7766. Both are near lows for the day.

Gold prices remain elevated at plus $21.50 or 1.45% at $1500.50.

The USD is mixed

- The USDJPY is seeing the safe haven flows and trades near lows for the day

- The USDCHF, which was up near 90 pips earlier after weaker CPI inflation, has moved back to mid range.

- The EURUSD moved to new highs on some dollar selling

- The GBPUSD has also recovered (dollar selling) after being lower on Brexit concerns earlier.

3

…Stocks are not liking the optics of it all

Pres. Trump is sounding off as he defends himself in the way he knows how. Below are a sampling of the recent tweets:

He is also on the wires saying:

- He thinks the whistleblower should be protected if he is a legitimate whistleblower

But adds:

- Person who provided whistleblower information is a spy

What does it have to do with the market?

Stocks continue to suffer, as things are seemingly more and more in disarray.

The S&P is currently down 56 points or -1.9% at 2884.30. The NASDAQ is down 142 points or -1.8% at 7766. Both are near lows for the day.

Gold prices remain elevated at plus $21.50 or 1.45% at $1500.50.

The USD is mixed

- The USDJPY is seeing the safe haven flows and trades near lows for the day

- The USDCHF, which was up near 90 pips earlier after weaker CPI inflation, has moved back to mid range.

- The EURUSD moved to new highs on some dollar selling

- The GBPUSD has also recovered (dollar selling) after being lower on Brexit concerns earlier.

Yeah, hi

Yeah, hi