Relatively mild gains observed in early trades

- German DAX futures +0.3%

- French CAC 40 futures +0.3%

- UK FTSE futures +0.2%

This is largely reflective of the mood seen in US futures, which are slightly higher as well to start the European morning.

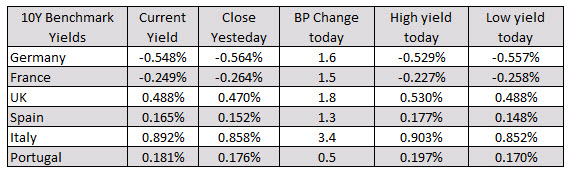

That said, the overall risk mood remains more measured with Treasury yields on the weaker side playing catch up to price action yesterday.

So far, there’s still the feeling that traders and investors are still quite indecisive about risk trades following the US-China trade truce. As such, the next set of headlines is likely the spot to watch to push risk towards a certain direction.

Why am I trading? This is not a trivial question to ask; and you must answer it honestly. Are you trading to make money? Or are you trading for the thrill? In other words, are you trading like an investor or like a gambler?

Why am I trading? This is not a trivial question to ask; and you must answer it honestly. Are you trading to make money? Or are you trading for the thrill? In other words, are you trading like an investor or like a gambler?