Plus $2.33 or 4.1%

The price of WTI crude oil futures are settling at $58.43. That is a gain of $2.33 or 4.1%. The move higher today was helped by a bigger than expected drawdown of inventories of -4856K versus -1500K estimate. News that Saudi Arabia is is threatening to keep production higher to punish producers who don’t keep to their quotas had little impact.

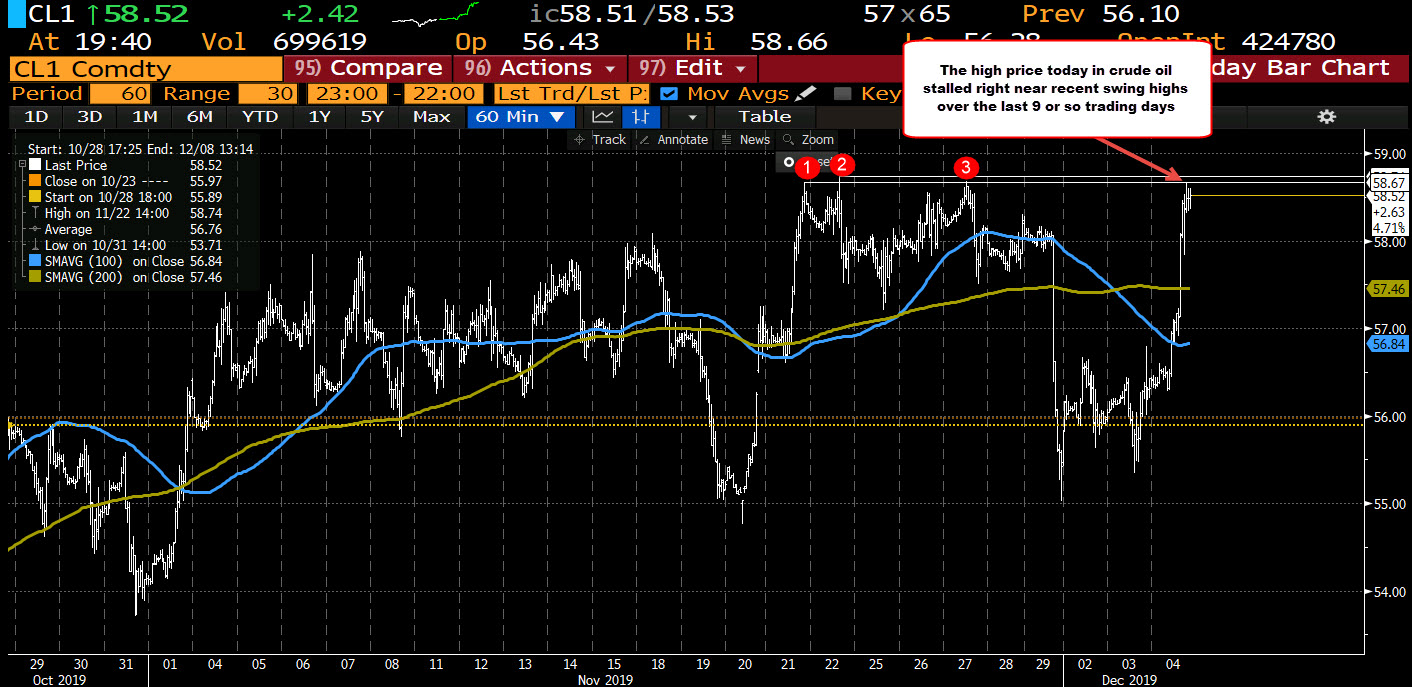

Looking at the 60 minute chart above, the contract spiked above its 100 hour and 200 hour moving averages (blue and green lines) and extended up to the recent highs over the last 9 or so trading days between $58.67 and $58.74. The high price today reached $58.66. The low for the day was down at $56.28.

A move above this ceiling would be more bullish for the contract. Staying below, and we could see a rotation back down toward the 200 hour moving average of $57.46.