Forex futures positioning data among non-commercial traders for the week ending June 25, 2019:

- EUR short 56K vs 52K short last week. Shorts increased by 4K

- GBP short 59K vs 53K short last week. Shorts increased by 6K

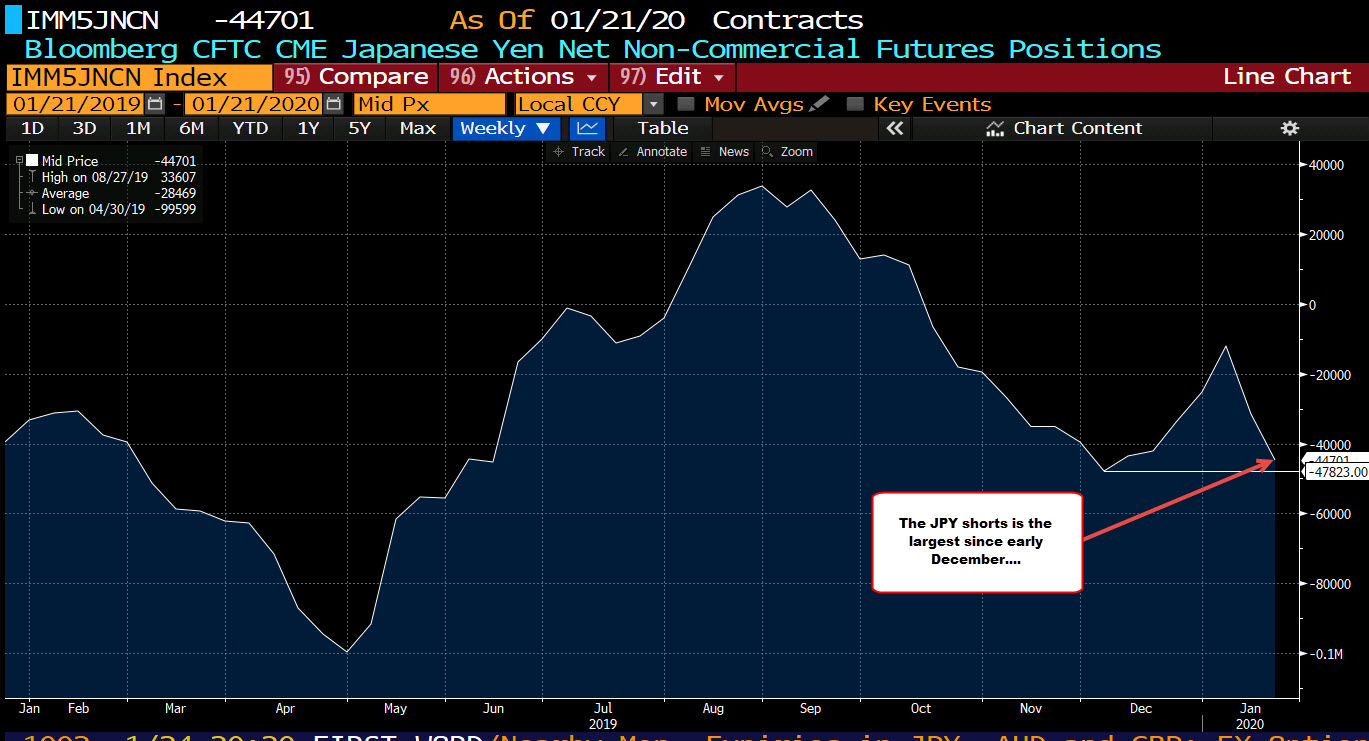

- JPY short 10K vs 17K short last week. Short trimmed by 7K

- CHF short 16k vs 15k short last week. Shorts increased by 1K

- AUD short 66k vs 65k short last week. Shorts increased by 1K

- NZD short 24K vs 24K short last week. Shorts unchanged

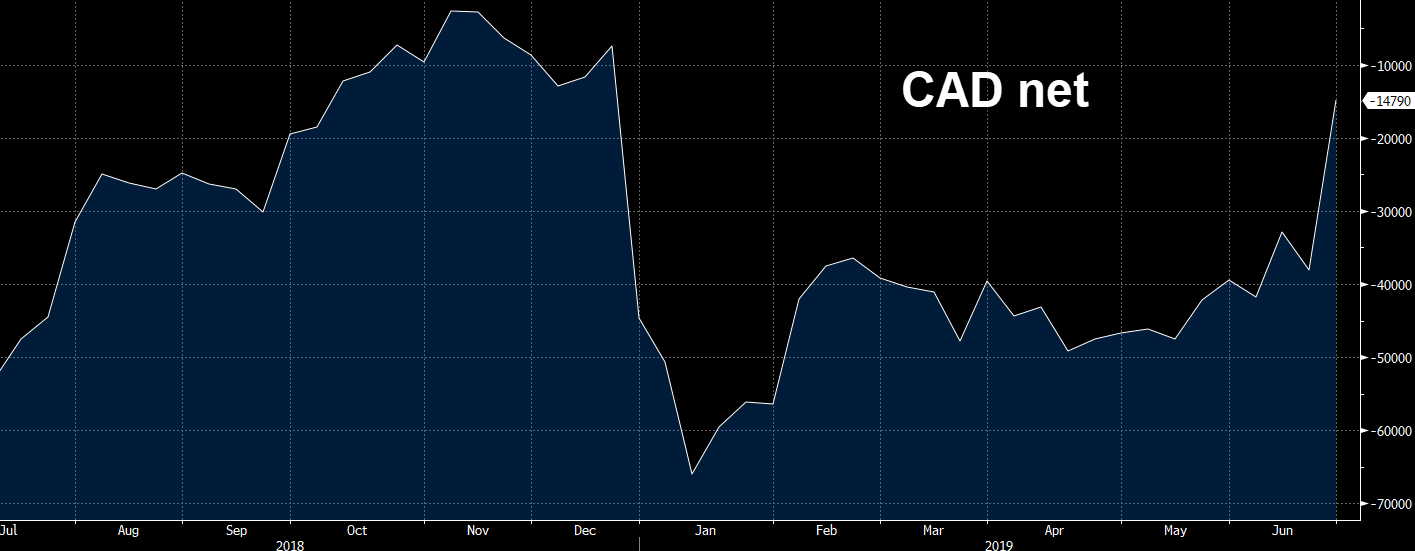

- CAD short 15K vs 38K short last week. Shorts decreased by 23K

That’s the second week in a row of GBP selling as the market sours on whatever might come from the Conservative change in leadership.

There was a big flight out of euro shorts a week ago but some waded back in this week. In the yen, however, they continued to get out of shorts, even with USD/JPY rebounding (although that came later in the week).

The big move was in the Canadian dollar where all the good news on Canadian data finally sank in and the shorts got out. That shift put the net at the narrowest since late December. I expect we will see more of the same when next week’s numbers are released.