The meeting will begin at 0000 GMT

- BOJ calls for unscheduled monetary policy meeting on 22 May

The central bank is likely to announce a new scheme to facilitate funding for banks to extend to small businesses that have been hit by the fallout from the coronavirus outbreak.

In short, it is yet another measure to bolster liquidity conditions in the financial system, in order to ease corporate funding strains.

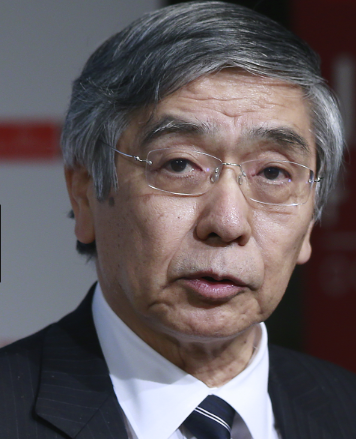

I don’t believe that the Kuroda & co. will offer any surprises beyond that, so expect other monetary policy tools to remain unchanged. They will likely just use the meeting to communicate the details of the new scheme if anything else.

As for the impact on the yen, I would argue that this should not play too significant of a role as the central bank has played it down and Kuroda has made mention to this in the past.

For USD/JPY, continue to keep an eye on the elusive 108.00 handle in any case.