Greek premier Lucas Papademos held last-minute talks on Sunday with international lenders on wage and pension cuts amid fears that political leaders may reject a second €130bn bail-out and plunge the country into a chaotic default.

Greek premier Lucas Papademos held last-minute talks on Sunday with international lenders on wage and pension cuts amid fears that political leaders may reject a second €130bn bail-out and plunge the country into a chaotic default.

Evangelos Venizelos, finance minister, said “It’s not an impasse but there are problems for the Greek side” over terms of a medium-term package being negotiated with the so-called “troika” – representatives of the European Commission, European Central Bank and International Monetary Fund.

The two sides were “quite far apart” over projected cuts of 25 per cent in private sector wages, 35 per cent in supplementary pensions and the immediate closure of about 100 state-controlled organisations with thousands of job losses, a Greek official said.

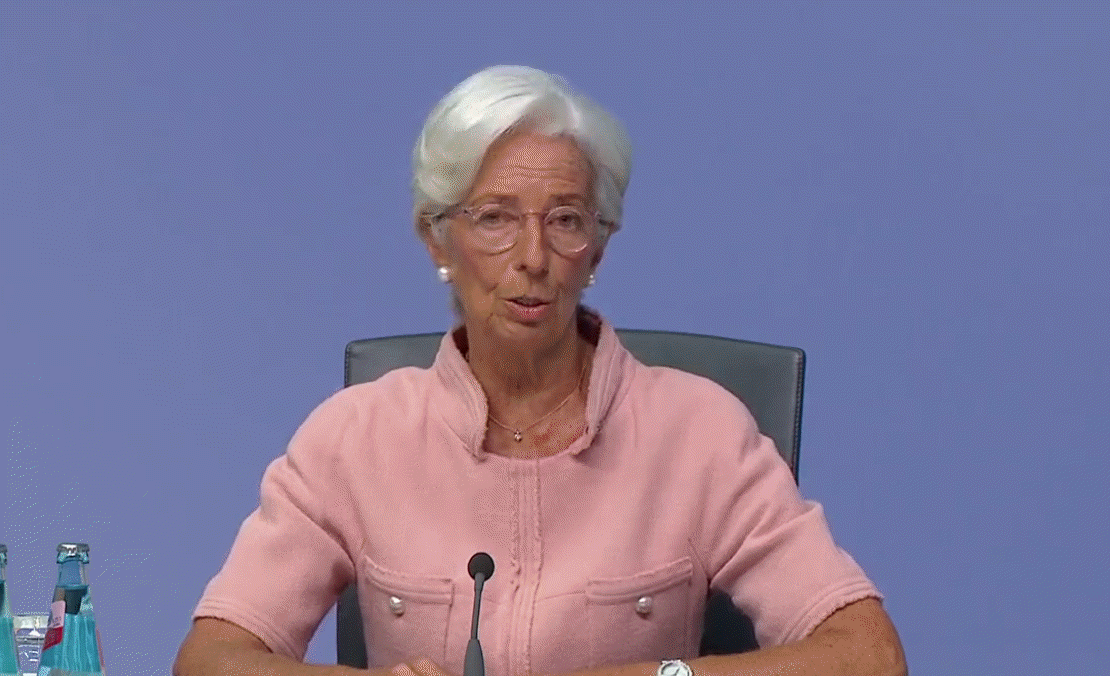

Mr Papademos held telephone conversations on Sunday with Christine Lagarde, IMF managing director and Mario Draghi, ECB president, in a bid to break the deadlock, the official added.

The three leaders of Greece’s national unity government were due to meet Mr Papademos later on Sunday to agree the package before it goes to eurozone finance ministers for approval next week.

It was not clear whether former socialist premier George Papandreou and Antonis Samaras, the conservative leader bidding to succeed him, would also meet the troika mission chiefs. (more…)