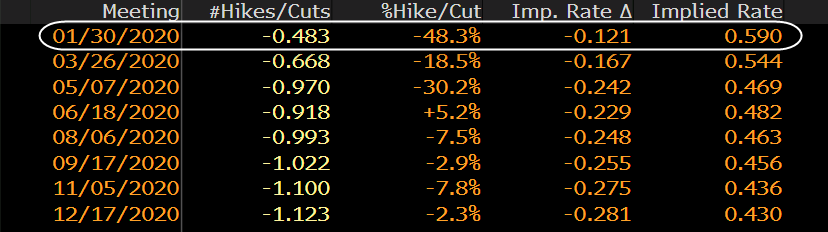

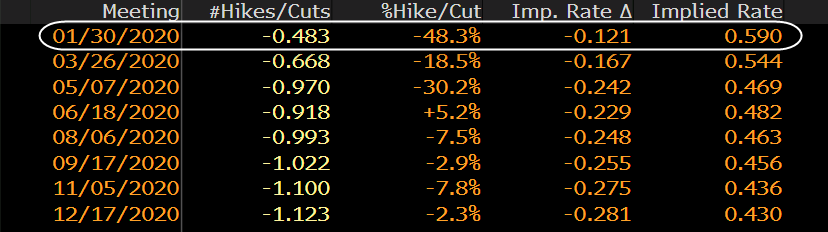

Odds of a 25 bps rate cut on 30 January falls below 50% from ~70% on Friday

![]() At last check Irish-Bund spreads were north of 725 bps, meaning Ireland is now effectively insolvent, and joins Greece in the group of bankrupt European countries. If this blow out is not stopped immediately, the contagion will again spread to the periphery first and then to the core shortly thereafter. The only question is when, just like in the case of oh so coy Greece, will Lenihan admit defeat and ask the IMF and the ECB for help (oh, and do it so during a Citigroup-mediated conference call). However, as Market News reports, citing Handesblatt, the Irish rescue may be imminent, and may come as soon as today.

At last check Irish-Bund spreads were north of 725 bps, meaning Ireland is now effectively insolvent, and joins Greece in the group of bankrupt European countries. If this blow out is not stopped immediately, the contagion will again spread to the periphery first and then to the core shortly thereafter. The only question is when, just like in the case of oh so coy Greece, will Lenihan admit defeat and ask the IMF and the ECB for help (oh, and do it so during a Citigroup-mediated conference call). However, as Market News reports, citing Handesblatt, the Irish rescue may be imminent, and may come as soon as today.

From Market News:

Eurozone governments are preparing for a possible Greece-style rescue for Ireland although the country has not yet asked for financial assistance, German daily Handelsblatt reported Thursday, citing German government sources.

(more…)

Poor, poor Europe. Every room one shines a light in, the cockroaches don’t even bother to scurry to safety any more. Yet what is glaringly obvious takes a media-reported soundbite to awake people. So is the case with Hungary today. After opening 7 tighter, Hungarian CDS are now 14 bps wider to 277bps. As the attached chart shows, the Hungarian Forint is now in freefall. Yet if investors are concerned about Hungary, they should take a look at some of its less lucky Eastern European neighbors which, just like Hungary, have been considered to be strong for so long.

For a demonstration of the unsustainable course that European sovereign funding is on, look no further than Spain, where earlier the government auctioned off €2.468 billion in three year notes for a whopping 3.717%. The bid to cover was 2.27 compared to 2.16 in October, and it was reported that foreign buyers bid above 60% of the auction (which means the ECB funded domestic banks bought about 40%). However, the same issued priced at 2.527% at the last sale on Oct. 7, a 119 bps difference. Still it wasn’t all bad, considering the bond had traded at almost 4% in recent days. As Reuters reports: “Analysts and bond market players had predicted a leap of as much as 2 percentage points in yields, but Madrid’s situation has been helped by mounting expectations the European Central Bank will step up extraordinary measures to contain the crisis.” The problem for Spain is that it has minimized the amount of debt it is issuing during turbulent times: “The Treasury had cut the amount of bonds on offer in order to trim financing costs as it faces down market doubts on whether it can bring down its deficit due to sluggish economic growth and persistent concerns it might need to bailout its debt-laden banks.” And the problem for the ECB is that it most likely, as many analysts are predicting, will not announce anything of substance, as otherwise the ECB will have to monetize up to €1.5 trillion in total debt and interest through the end of 2011. The result for the EUR will inevitably be disastrous in either case, and if in 25 minutes JCT indeed announces nothing, look for all those who bid up the bond auction earlier to be tearing out their hair as the 3 Year promptly passes 4%.

For a demonstration of the unsustainable course that European sovereign funding is on, look no further than Spain, where earlier the government auctioned off €2.468 billion in three year notes for a whopping 3.717%. The bid to cover was 2.27 compared to 2.16 in October, and it was reported that foreign buyers bid above 60% of the auction (which means the ECB funded domestic banks bought about 40%). However, the same issued priced at 2.527% at the last sale on Oct. 7, a 119 bps difference. Still it wasn’t all bad, considering the bond had traded at almost 4% in recent days. As Reuters reports: “Analysts and bond market players had predicted a leap of as much as 2 percentage points in yields, but Madrid’s situation has been helped by mounting expectations the European Central Bank will step up extraordinary measures to contain the crisis.” The problem for Spain is that it has minimized the amount of debt it is issuing during turbulent times: “The Treasury had cut the amount of bonds on offer in order to trim financing costs as it faces down market doubts on whether it can bring down its deficit due to sluggish economic growth and persistent concerns it might need to bailout its debt-laden banks.” And the problem for the ECB is that it most likely, as many analysts are predicting, will not announce anything of substance, as otherwise the ECB will have to monetize up to €1.5 trillion in total debt and interest through the end of 2011. The result for the EUR will inevitably be disastrous in either case, and if in 25 minutes JCT indeed announces nothing, look for all those who bid up the bond auction earlier to be tearing out their hair as the 3 Year promptly passes 4%.

The crunch in funding continues. There is $673 billion in Commercial Paper maturing over the next month and a half. The problem is that the rolling of all this paper will come at increasingly higher costs. Today the market for US 7 Day CP hit level of 0.61%. As the chart below indicates, the current CP rate is not only the highest in 2010, but higher than CP costs during the March 2009 market lows. More worrying is that despite the recent unprecedented volatility in daily rate swings, the trend is one of an accelerated increase. At this rate of increase, the Fed may soon need to put the CPFF program back in play.The most worrying is the implication 7 Day CP rates have for the FF rate: while 7 Day CP historically has tracked the Fed Funds tick for tick, over the past few months we have once again seen a major divergence between the two. In this closest proxy to short-term funding, the market is now notifying Bernanke that the Fed Funds rate is now about 36 bps off and increasing.

And the spread to the Fed Funds rate: