Results of the latest study

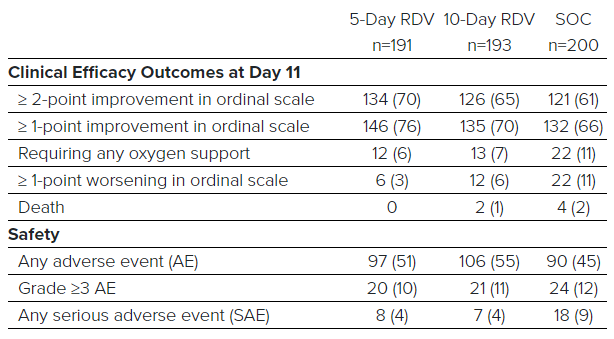

Gilead released its latest study results of patients with moderate COVID-19 and reported that patients on a 5-day tready were “65 percent more likely to have clinical improvement at Day 11 compared with those in the standard of care group.”

The company was upbeat about the results.

“These study results offer additional encouraging data for remdesivir, showing that if we can intervene earlier in the disease process with a 5-day treatment course, we can significantly improve clinical outcomes for these patients.”

Here is the data. It’s not a miracle cure but I’d certainly rather have it if I had the virus.

The issue is that it needs to be administered in a hospital and is expensive. That makes it unfeasible in some parts of the world.

Shares of the company are up 10% in the pre-market and the report briefly boosted stock market futures.

Secret message?

Secret message?