The volatility playbook for the week ahead

After a week where markets have had to try and understand the potential fallout on the Chinese economy from the coronavirus outbreak, a more dovish BoC, a reasonable Aussie jobs report, and solid UK data, we head into the new week with a number of moving parts through which to navigate.

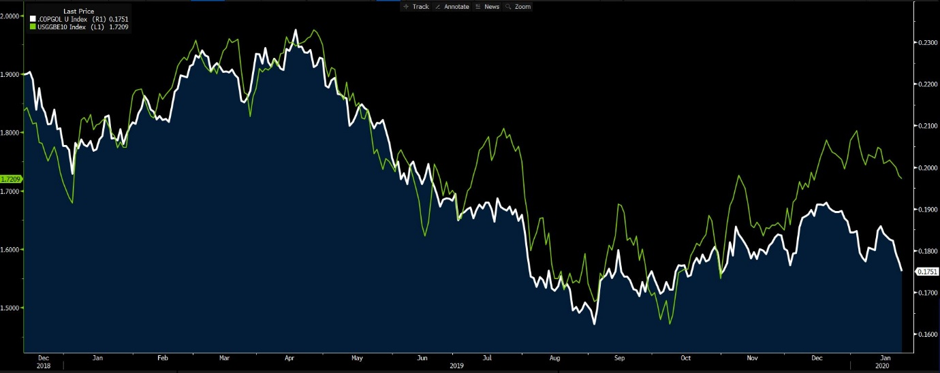

One aspect that I have addressed in the ‘Week Ahead’ playbook is the message I am seeing from the US bond market and it is a play that is progressively suggesting more risk averse positioning. It gives me some belief that implied volatility in markets could start to respond and move higher. I have mentioned in reports of past that the bond market has never fully bought into the reflation trade that so many economists had got quite excited about going into 2020. Where, if I look at the long end of the US Treasury or German bund curve, or even the copper/gold ratio, the market is saying reflation is a pipe dream, and instead, we may actually be too optimistic about the global growth story.

(Green – US 10-year inflation expectations, white – copper/.gold ratio)

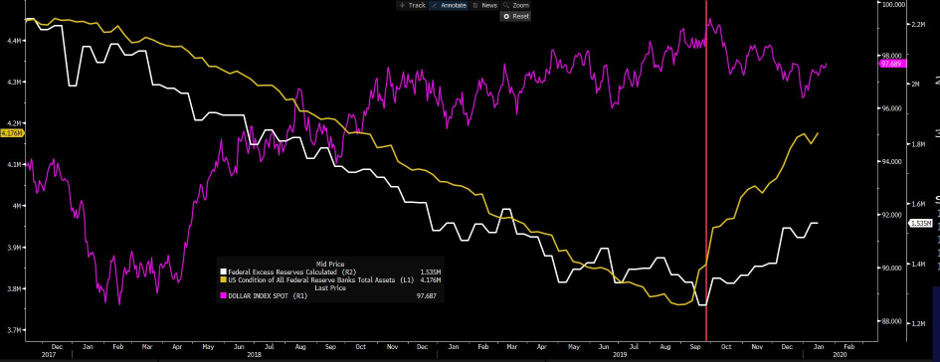

We know the FOMC meeting is this coming week and while no one expects a change in the fed funds rate, we are expecting Jay Powell to be intensely probed about the Fed’s balance sheet and measures to support the repo market. Risk markets, such as equities, have been supported by changes to excess reserves, which despite calls to the contrary from the Fed, the market has taken these changes as QE, and this may well be coming to an end – or, should I say, the expansion of reserve growth will soon abate.

(White – excess reserves, yellow – Fed’s balance sheet, purple – USD index)