Bernard Baruch on inside information: “The longer I operated in Wall Street, the more distrustful I became of tips and “inside” information of every kind. Given time, I believed that “inside” information can break the Bank of England or the United States Treasury”.

Baruch adds that most “inside information” is designed to mislead the gullible and that corporate insiders are just as likely to be led astray by their “infallible” informational advantage and belief in the company. His comments closely resemble Jesse Livermore’s sentiments on stock tips and insider information.

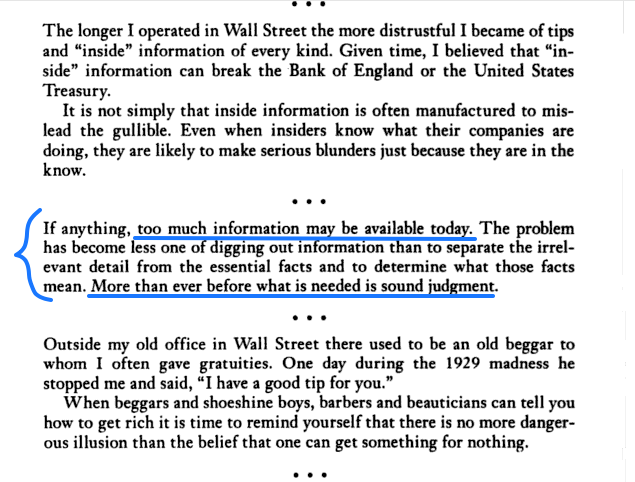

Trading on tips: Echoing Joseph Kennedy’s anecdote about the stock-tipping shoe shine boy of 1929, Baruch relates his own tale of taxi drivers, shoe shine boys, and beggars offering hot stock tips and market analysis.

(more…)