Via HSBC, beginning with where we are at:

- latest national opinion polls show Senator Joe Biden maintaining a healthy lead over President Trump

- although lower than the double-digit gap reached in late June

- Biden’s strong polling performance has coincided with a period of high US unemployment as the country grapples with the Covid-19 pandemic and a period of heightened social tensions earlier this summer

But, that could change:

- A number of factors could materially shift either candidate’s standing in the coming weeks.

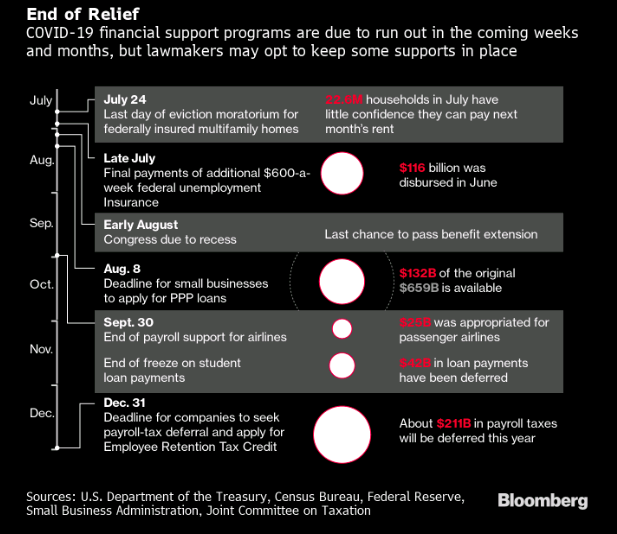

- Positive for Trump would be developments that lead to a faster economic recovery. This may include the potential for the pandemic to subside or further progress to be made with treatments and/or vaccines. Congress passing a new stimulus package that includes an extension to the unemployment insurance top-up will also be considered important.

- Other factors complicate the picture. There is uncertainty about the impact of increased mail-in voting due to the pandemic. Meanwhile, the US Electoral College system places greater importance on ‘battleground states’ to the final result, making national polls a less useful predictor. In the majority of these states, Biden is forecast to do worse than at the national level.

For markets:

- The outcome of the election poses some potential downside risks to US equity markets.

- These include the possibility of a divided government and “deadlock” over fiscal policy support, while Biden may implement higher corporate taxes.

- For the time being, we maintain our overweight view on US equities as the “swoosh” economic recovery remains in play.”