S&P index closes just below breakeven level for 2020

The US stocks are ending the session with gains across the board. The gains are led by the S&P index which rose by 0.91%. The NASDAQ index lagged, but still gained 0.59%.

For the S&P index, it toyed with closing above the breakeven level for the year for the 1st time since February 25. However, that quest failed. The index is ending the day 0.13% from that breakeven level (2019 closes at 3230.78 while the close today is at 3226.56).

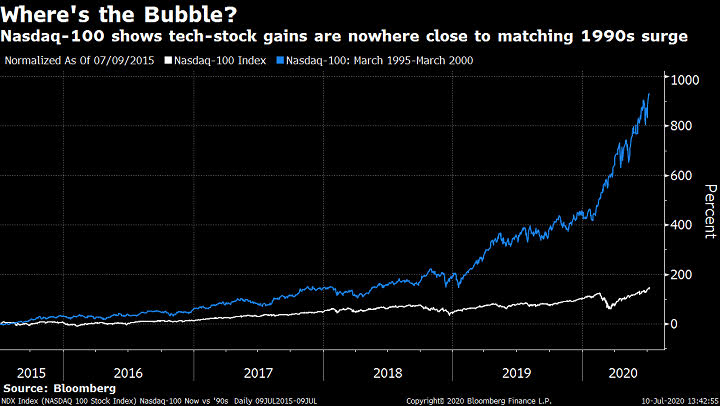

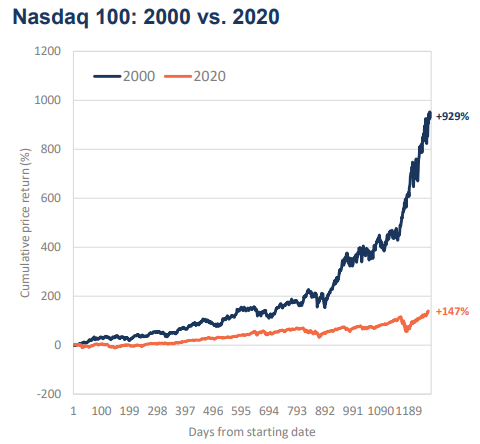

This week there has been a rotation out of the high flying tech stocks vs. the broader/industrial stocks. For the last 5 trading days the Dow industrial average is up 3.08% and the S&P index is up 1.79%, while the tech heavy NASDAQ index is up only 0.55%.

Nevertheless both the NASDAQ and the S&P index are up for 2 consecutive days. The Dow is riding a 4 day win streak.

The final numbers are showing:

- S&P index +29.03 points or 0.91% at 3226.55

- NASDAQ index up 61.915 points or 0.59% at 10550.49

- Dow up 227.51 points or 0.85% at 26870.10.

Will tomorrow be the day for the S&P index to close the black? Maybe, but going forward headline news from more earnings releases, coronavirus cases, vaccines and therapeutics will continue to exert their influences. Each of which could upset the apple cart in a bullish or bearish direction.