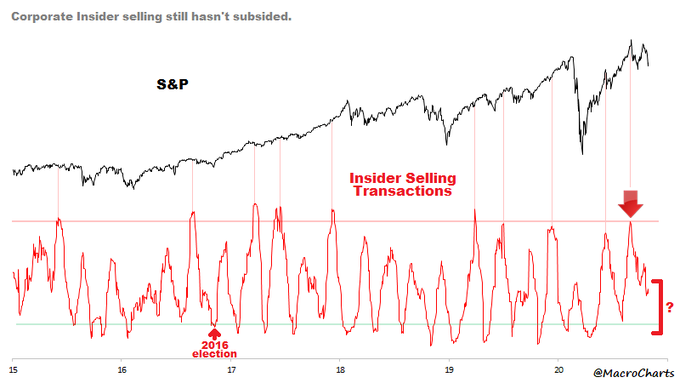

More important: they haven’t stopped selling – there’s room to push much lower if they want. This isn’t 2016.

Archives of “US Market” category

rssBofA say a contested US election could slice 20% off stocks

BoA on a risk for the US election.

- A “landslide victory for either Trump or Biden and rapid election conclusion would likely be welcomed by markets while a severely contested election could see risk-off and drive 10-year rates materially lower”

- “If Trump leads on Election Day with a large backlog of absentee and mail-in ballots, stocks could see more volatility until more results come in”

BoA citing 2000 – the S&P 500 sold off 5% before the Supreme Court called the election for George W. Bush on December 12

Info comes via Bloomberg, more at the link (may be gated)

S&P 500 Performance According to the US President

Valuation of the American market.

Amazon, Facebook, Twitter, Alphabet all come in better than expectations

Amazon:

- revenues $96.15 billion vs.$92.70 billion estimate

- EPS $12.37 vs. $7.41 estimate

- the caveat is AWS numbers came in about expectations and apparently there was favorable taxes

- Amazon shares are trading down at $3163 after closing at $3211

Facebook

- EPS $2.71 vs. $1.91 estimate

- revenues $21.47 billion vs. 19.28 billion estimate

- Facebook shares are trading down at $275 after closing at $280.83

- revenues 936 million vs. 777 million estimate

- earnings-per-share $0.19 adjusted vs. $0.06 estimate

- Twitter is trading down at $46.33 after closing at $52.43

Alphabet

- revenues 46.17 billion vs. 42.90 billion estimate

- earnings-per-share $16.40 vs. $11.29 estimate

- Alphabet shares are trading up at $1638 after closing at $1556.88

Starbucks

- earnings-per-share $0.51 vs. $0.31 estimate

- revenues $6.2 billion worth of $6.06 billion estimate

- Starbucks shares are trading up at $89.40 after closing at$88.30

US equity close: Good bounce back but some softness into the close. Onto earnings

Closing changes

The US equity market posted a good bounce-back after yesterday’s big rout. It looked like more trouble early today as stocks gave back early gains and turned negative but in the New York morning the turn started and it got some momentum after lunch until some late selling ahead of tech-earnings extravaganza.

- S&P 500 +39 to 3310 +1.2%

- Nasdaq +1.6%

- DHIA +0.5%

Fear is more powerful than euphoria.

A very busy year.

Major indices plunge on Covid/election fear. Close near session lows

Big day today on the earnings front

The major indices fell sharply on Covid/election fears. European countries imposed new restrictions. Case count continue to rise putting pressure on hospitals. A lack of a coronavirus stimulus deal in the US is also weighing. Finally, uncertainty about the upcoming election is also frightened traders. The volatility index (Vix index )rose by 19.31% to close to 40.

Some of the highlights in the numbers today

- Dow closes down for the 4th consecutive day

- Dow has the longest losing streak since February

- Dow closes at the lowest level since July 31

- Dow closed below its 100 day moving average at 27250.30. Approaches its 200 day moving average at 26226.46

- S&P has a 3 day losing streak

- S&P sees all 11 sectors moved to the downside

- S&P index closed below its 100 day moving average at 3306.05

- NASDAQ index closed below its 50 day moving average at 11313.65, but above its 100 day moving average at 10870.86

The final numbers are showing:

- S&P index fell -119.51 points or -3.52% to 3271.17.

- The NASDAQ index fell by -426.48 points or -3.73% to 11004.86.

- Dow industrial average fell minus hundred 42.18 points or -3.43% to 26520.74