To read more enter password and Unlock more engaging content

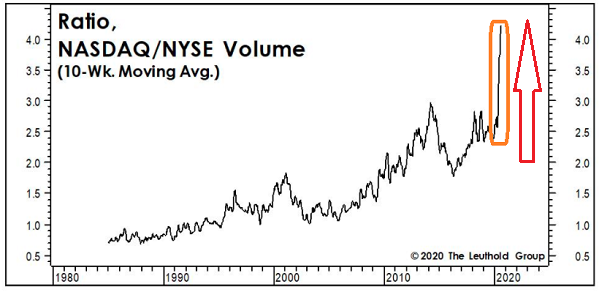

Worried about a stock market crash? Are stocks overheated? When will the bubble pop? Suddenly you see your portfolio crashing down as a series of economic events and malinvestments build up and get realized into simple price action. A bubble builds up with hype and euphoria feeding its growth up until the time comes when the bubble bursts and the crash materializes. Despite the burden of a crash, a bunch of professional investors wait for such opportunities to cease above average returns. They have enough discipline and foresight to look ahead and anticipate that after a crash, a perfect timing to buy does exist, giving their portfolio a skewed return on investment.When the pandemic first hit the world last year, financial markets and most asset classes took a huge hit, triggering a short-lived bear market. The stock market fell by an approximate 20% and a global economic recession followed. However, after the sharp nosedive in March of 2020, the market began a subtle recovery. All indices rose again, euphoria took a seat again, and by December 31, the stock market had regained all its lost ground.

(more…)

Worried about a stock market crash? Are stocks overheated? When will the bubble pop? Suddenly you see your portfolio crashing down as a series of economic events and malinvestments build up and get realized into simple price action. A bubble builds up with hype and euphoria feeding its growth up until the time comes when the bubble bursts and the crash materializes. Despite the burden of a crash, a bunch of professional investors wait for such opportunities to cease above average returns. They have enough discipline and foresight to look ahead and anticipate that after a crash, a perfect timing to buy does exist, giving their portfolio a skewed return on investment.When the pandemic first hit the world last year, financial markets and most asset classes took a huge hit, triggering a short-lived bear market. The stock market fell by an approximate 20% and a global economic recession followed. However, after the sharp nosedive in March of 2020, the market began a subtle recovery. All indices rose again, euphoria took a seat again, and by December 31, the stock market had regained all its lost ground.

(more…)