Archives of “US Market” category

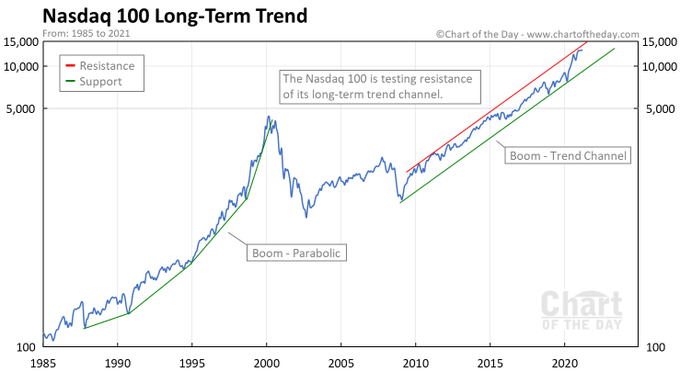

rssNothing better than logarithmic scale graphics.

Major indices close higher and near the highs for the day

NASDAQ down 5 of the last 6 trading weeks

The major indices are closing higher and near the highs for the day as buyers push prices higher in the last hour of trading. Trading conditions were once again very choppy trading today suggestive of a market that continues to have ebbs and flows:

- Dow, S&P, NASDAQ had their best day in more than 2 weeks NASDAQ close lower

- NASDAQ closes lower for the 5th time in 6 trading weeks

- Dow transports close at a record

- Dow, S&P and NASDAQ are now on a today winning streak

The final numbers are showing

- S&P index rose 65.02 points or 1.66% at 3974.54

- NASDAQ index rose 161.04 points or 1.24% at 13138.72

- Dow rose 453.4 points or 1.39% at 33072.88

- Russell 2000 index rose 38.36 points or 1.76% at 2221.48

For the trading week, the S&P index was the biggest winner at 1.57%. The NASDAQ index fell -0.58%. The Dow industrial average rose by 1.36%. Below are the percentage changes of the major global equity indices this week:

Did you know? Between 1980-2019 75% of SP500 $SPY returns have come from dividends

Here’s a forecast for S&P500 at 4,100 as a ‘base case’ this year (4,600 in most bullish scenario)

Scanning some research notes, this one to cheer up the stock market bulls after a down day.

Via RBC on the S&P500 (in summary):

- Our 2021 S&P 500 target of 4.100 is our base case. It is roughly the median of 15 upside scenarios that we examined. If our call proves too conservative, our analysis suggests that the S&P 500 could trade as high as 4,600 for a +20% full year gain – the most bullish scenarios we examined came close to this level.

- Among the eight downside scenarios we examined, which articulate our bear case for full year or interim downside if momentum breaks lower, several point to a pullback to the 3600 / 3700 area (mid single digit drop in percentage terms depending on the starting point used) or to -3,200 (mid to high teens dip in percentage terms depending on starting point).

An ugly day for the NASDAQ. Major indices close at lows

Dow turns negative at the close

It was an ugly day for the NASDAQ index. It fell 2% on the day on a decline of 265.8 points. The S&P index and Dow were down more modestly but both closed at the session lows.

The declines today cannot be blamed on yields moving higher. The treasury curve is lower across the board with the 10 year down 1.75 basis points. The 30 year is down -2.3 basis points.

The Dow, S&P, and NASDAQ have 2 day losing streaks. The Russell 2000 is lower for the 3rd straight day.

A look at the closing levels is showing:

- S&P index fell -21.38 points or -0.55% at 3889.14

- Nasdaq index fell -265.80 points or -2.01% at 12961.89

- Dow fell -3.09 points or -0.01% at 32420.06

- Russell 2000 fell -2.35% or -51.42 points at 2134.27

Big losers today included:

- Gamestop, -33.66% to $120.57. The company announced earnings after the close yesterday

- Koss, -21.06%

- Nio, -10.25%

- Bed Bath and beyond, -8.08%

- Zoom -7.25%

- Chewy, -6.91%

- Palantir, -5.91%

- Snowflake, -5.11%

- Beyond Meat, -5.0%

- Goodrx, -4.95%

- Teslas, -4.82%

- DoorDash, -4.73%

- Crowdstrike, -4.67%

- Airbnb, -4.41%

- Square, -4.33%

All those stocks are grouped as some of the high flying stocks of 2020.

Looking at some of the big cap losers:

- Facebook, -2.93%

- Netflix, -2.68%

- Salesforce, -2.55%

- Intel, -2.33%

- Disney, -2.1%

- Apple, -2.01%

- Amazon, -1.51%

- Microsoft, -0.91%

- Boeing, -0.87%

- Alphabet, -0.35%

Winners today:

- Schlumberger, +2.81%

- Chevron, +2.74%

- Exxon Mobil, +2.06%

- Stryker, +1.86%

- DuPont, +1.82%

- Honeywell, +1.77%

- American Express, +1.73%

- Caterpillar, +1.36%

- Charles Schwab, +1.2%

- Home Depot, +1.05%

- Corning, +0.95%

- General Dynamics, +0.9%

- Boston scientific, +0.89%

- J.P. Morgan, +0.77%

S&P and Nasdaq give back yesterday’s gains. Russel 2000 tumbles

Dow falls -300 points

The S&P index and NASDAQ gave back most if not all of the gains yesterday.

- NASDAQ index closed lower for the 1st time in 3 sessions

- NASDAQ nearly gave back all the gains from yesterday. The index rose 162 points yesterday and fell about 150 points today

- S&P index gave back all the gains from yesterday. It rose 0.7% yesterday and fell -0.76% today

- Russell 2000 index tumbled by -3.58% after falling -0.9% yesterday

The final numbers are showing:

- S&P index -30.07 points or -0.76% at 3910.52

- Nasdaq index fell -149.84 points or -1.12% at 13227.69

- Dow fell -308.05 points or -0.94% at 32423.15.

Nasdaq closes higher for the 2nd consecutive day and leads the indices higher

Dow and S&P lag. Russell 2000 closes lower for the 2nd time in 3 days

The NASDAQ close higher for the second consecutive day. It led the major indices higher with the S&P and Dow lagging well behind. The small-cap Russell 2000 index lags with a decline of -0.90%.

The final numbers are showing:

- S&P index +27.48 points or 0.70% at 3940.58

- Nasdaq +162.31 points or 1.23% at 13.377.54

- Dow +102.97 points or 0.32% at 32730.94

- Russell 2000 index, -20.70 points or -0.90% at 2266.84.

Winners today included:

- Box, +4.7%. Activist investors are pushing for a sale of the company

- Chewy, +4.01%

- Fireeye, +3.89%

- Lam research, +3.24%

- Intel, +2.96%

- Apple, +2.82%

- Cisco, +2.8%

- Nvidia, +2.69%

- Microsoft, +2.47%

- Adobe, +2.47%

- Pepsi, +2.47%

- General Mills, +2.4%

Some losers today included banks and financials and airlines:

- American Airlines, -4.61%

- United Airlines, -4.05%

- GameStop, -2.93%

- General Motors, -2.88%

- J.P. Morgan, -2.68%

- Southwest Airlines, -2.64%

- Bank of America, -2.23%

- Delta Air Lines, -2.14%

- Charles Schwab, -1.95%

- Boeing, -1.81%

- Goldman Sachs, -1.39%

- travelers, -1.15%

US futures ramp higher as the early jitters abate

S&P 500 futures up 0.3%

The collapse in the Turkish lira has been met with a bit of a pause in European morning trade so far, with USD/TRY ranging between 7.80 and 8.00 for the most part after having opened with a 15% gap higher at 8.35 earlier in the day.

The relative “calm” is helping to see risk assets recover on the session now ahead of North American trading with the dollar also falling to the lows of the day.