Markets:

- Gold up $29 to $1755

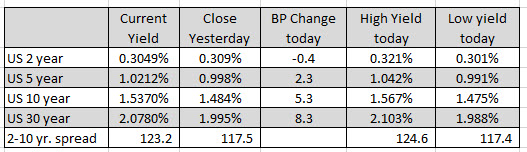

- US 10-year yields down 2.2 bps to 1.516%

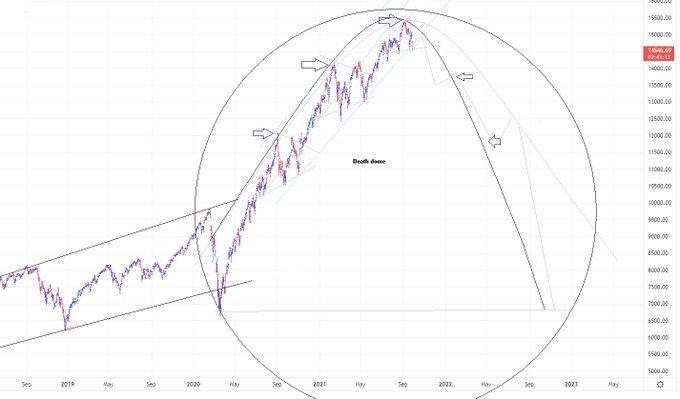

- S&P 500 down 52 points to 4307

- WTI crude oil up 43-cents to $75.27

- AUD leads, EUR lags

- On the month, USD leads, GBP lags

All bets are off at quarter end and we saw that in every direction today, including some ugly late selling in equities after what had been a positive start.

The US dollar gave back a big chunk of its recent gains on a few fronts, particularly versus the yen and commodity currencies. Cable bounced a half cent after a couple of bruising days while the euro couldn’t even muster a dead cat bounce.

US political headlines were coming from all over the place but it would be hard to tie them directly to price action in markets. Along the same lines, the market didn’t react to the miss in initial jobless claims.

The headline about China buying energy at any cost helped to lift gas and oil prices. That also gave the loonie a lift.

Quarter end flows were a big factor all around but it’s tough to say exactly how much was flows and how much was worry about: Inflation, bottlenecks, China, Washington and energy. There’s so much to unpack in markets at the moment and maybe it’s the combination that’s the real story.

Dow up over 700 points at the session highs

Dow up over 700 points at the session highs