Wall Street notched fresh record highs in cautious trading on Monday as investors awaited the first onslaught of quarterly earnings reports.

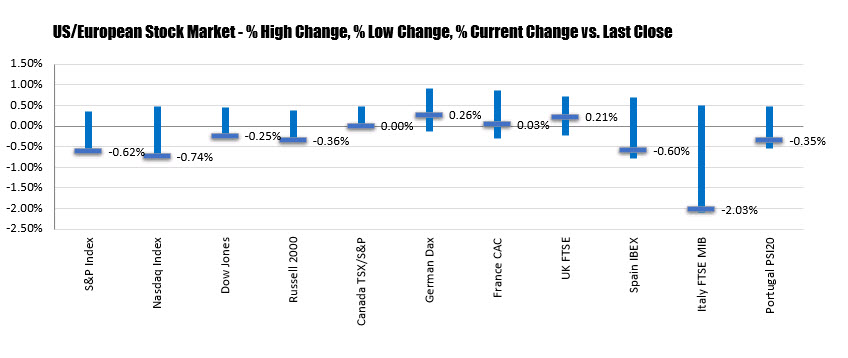

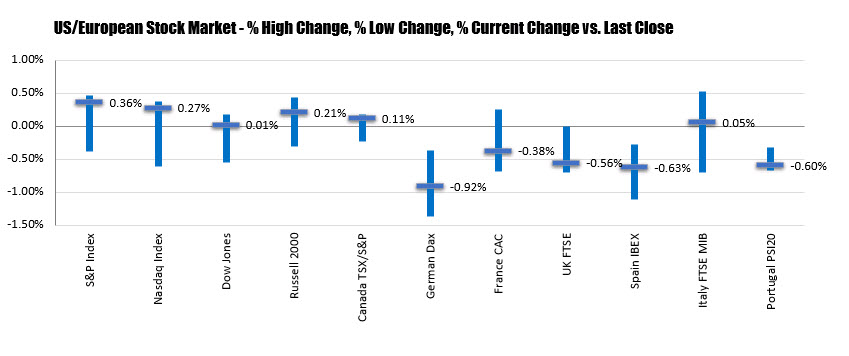

The S&P 500 bounced off session lows seen in afternoon trading to gain about half a point at 3,014.30. The Dow Jones Industrial Average ticked 0.1 per cent higher, and the Nasdaq Composite rose 0.2 per cent.

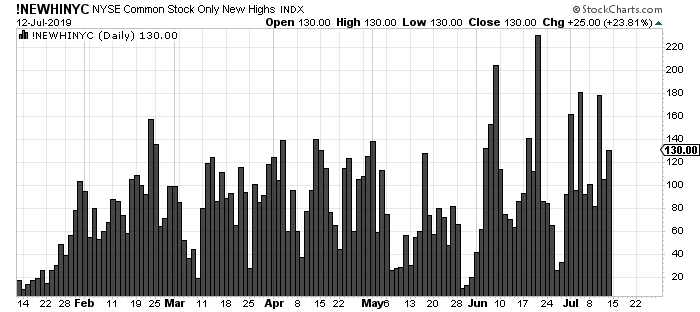

The modest rally extended a record run on Wall Street that was fuelled last week by expectations for looser monetary policy at the Federal Reserve. The benchmark S&P 500 secured its third closing high in as many sessions, while the Dow and tech-heavy Nasdaq set records for a second consecutive day.

Citigroup offered the opening salvo in a busy week of bank earnings. Goldman Sachs, JPMorgan Chase and Wells Fargo will file on Tuesday. Bank of America’s financials will arrive a day later.

Citi’s shares fell 0.1 per cent, paring a gain of 1.5 per cent made last week in the run-up to its numbers.

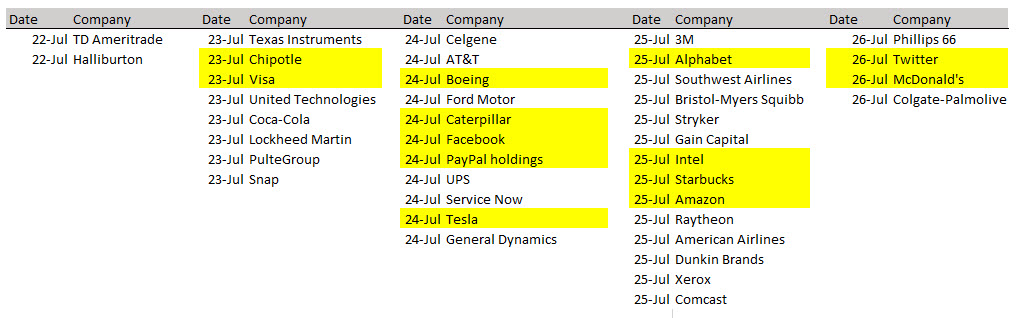

A number of further corporate reports due throughout the week will start to reveal if the US is on course for its first earnings recession since 2016, playing into investors’ perceptions of the outlook for the economy as the Trump administration’s trade dispute with Beijing continues.

Growth data from China published on Monday showed the country’s rate of quarterly expansion was its slowest in 27 years at 6.2 per cent, but there was relief that the tariff battle between the world’s two biggest economies had not taken a deeper toll on the data.

Early gains on Wall Street helped European bourses consolidate gains after an uncertain showing in the region. The international Stoxx 600 rose 0.2 per cent.

Frankfurt’s Xetra 30 was up 0.5 per cent. London’s FTSE 100 rose 0.2 per cent, with its gains underpinned by miners.

Some winners today included:

Some winners today included: