The Fed meets this week, but don’t get your hopes up for big changes in policy or additional details about the Fed’s new “average inflation targeting” strategy. The Fed’s objective is to maintain policy flexibility rather than to commit to a time frame by which to reach the average 2% inflation goal

. For the moment, the Fed remains content to simply entrench expectations that the policy path is locked down at zero for the foreseeable future. There are some risks to this strategy.This is important, so let’s all pay attention: The Fed’s new “average inflation target” strategy is not really an “average inflation target” strategy. Federal Reserve Chair Jerome Powell described it as “flexible average inflation targeting.” What does “flexible” mean?

It means the Fed gets to make up the definition of success as they see fit. There is no fixed time frame associated with meeting the target which means the target really isn’t a target. I know some journalist is going to ask for specific details at this week’s press conference, but I very much doubt they are going to get anything more specific out of Powell.

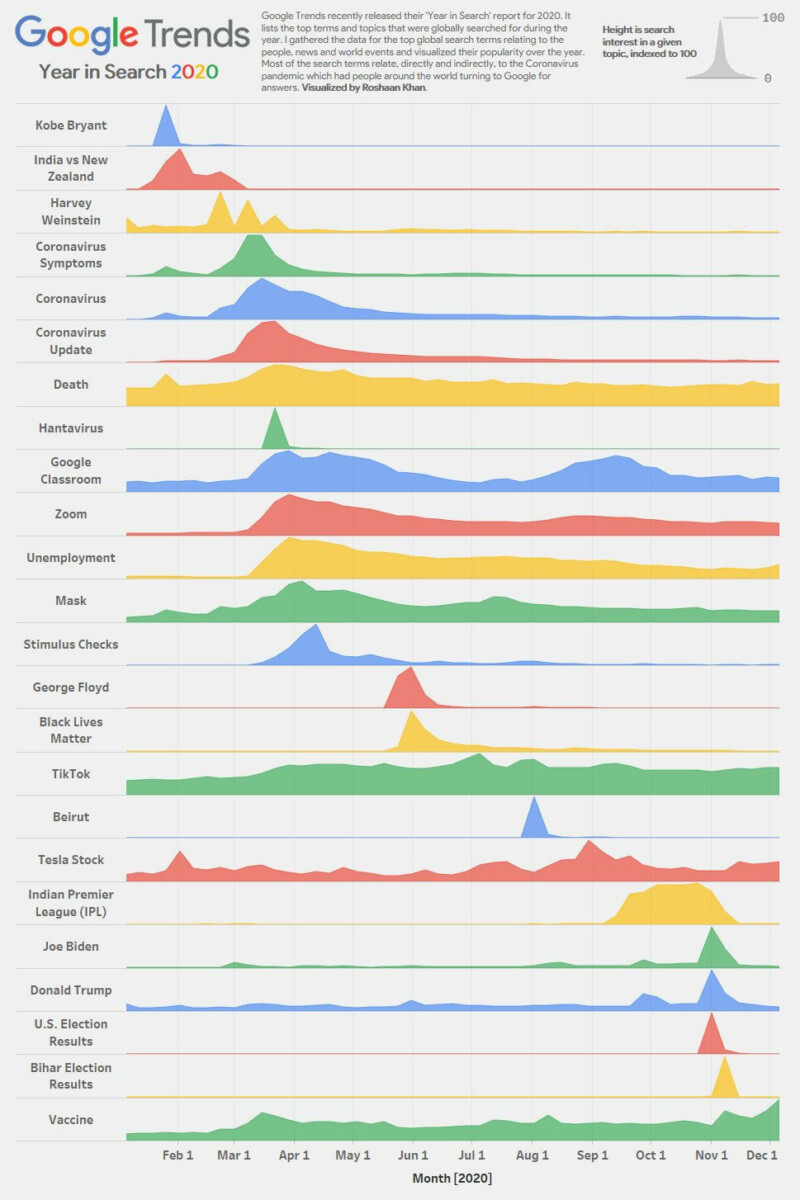

So what then is the benefit of the Fed’s new strategy? It allows the Fed to let inflation run above 2%, something they did not consider an option under the previous inflation targeting strategy. This is an important and meaningful change. It’s particularly important in the context of a recovery that appears more rapid than anticipated. Along with the more rapid recovery is a faster pace of inflation:

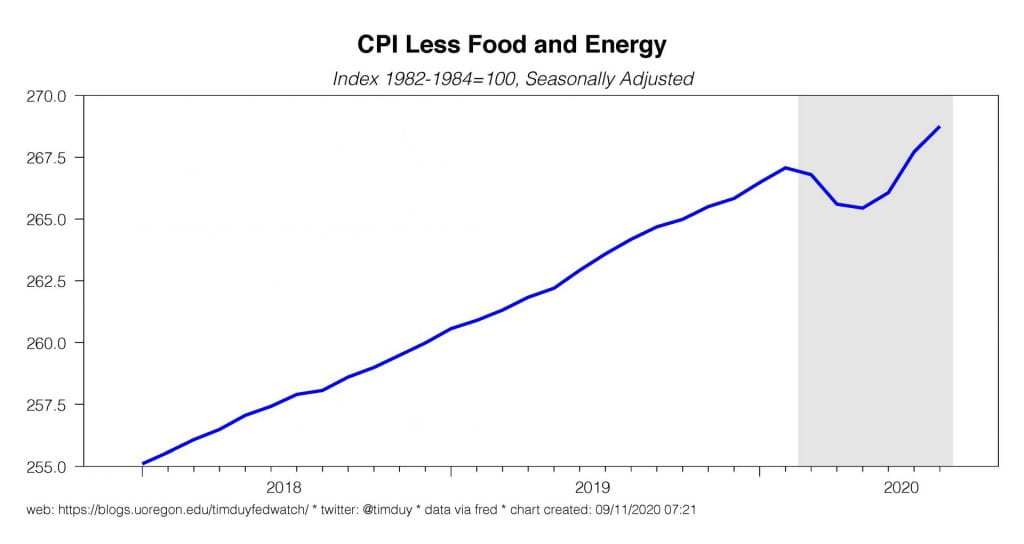

And note that the price level looks to be returning to its pre-Covid trend, something you might consider a victory under average inflation targeting:

In the last cycle, we would be looking at those numbers and, in the context of the more rapid than anticipated decline in the unemployment rate, start thinking that maybe the Fed would be shifting into a more hawkish direction. But we aren’t thinking that now. Now we are thinking that there is nothing in the data to prompt a more hawkish reaction from the Fed. We don’t think falling unemployment is by itself meaningful nor do we think inflation at or even modestly above 2% necessarily prompts a hawkish reaction from the Fed. Instead, the Fed is content to allow real interest rates to continue to drop and presumably content to allow them to fall even a notch further than the last cycle:

.jpg)