Thought For A Day

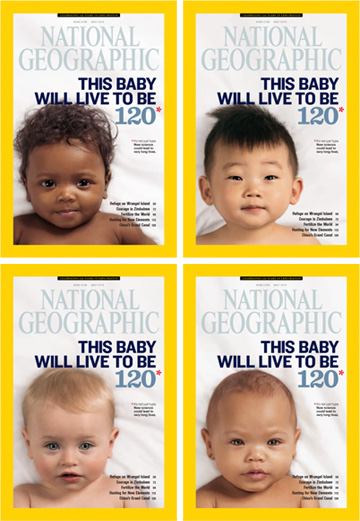

Our genes harbor many secrets to a long and healthy life. And now scientists are beginning to uncover them.

The cover story in National Geographic this month is off the hook – if you’re a believer in the big healthcare secular bull market and fascinated by demography’s effects on economics (as we are), you’re going to want to check this out. They did four different covers, pretty cool:

Longevity (National Geographic)

The Law of Value The Law of Compensation The Law of Influence The Law of Authenticity The Law of Receptivity |

Buffett: “Rule#1 is never lose money. Rule#2. is never forget Rule#1.”

Buffett: “Rule#1 is never lose money. Rule#2. is never forget Rule#1.”

Sounds impractical and ridiculous to most people.

That’s because there’s something wrong with their own approach and that is why the rules don’t resonate with them.

If your approach and methods are correct, the rules should make sense to you.

Whether you invest or trade, your account should steadily increase with time, if your stock market approach indeed follows Rule#1.

So…if you are looking for help, seek those who have some sort of stock market record, preferably public, that shows consistent increase over time.

You won’t get access to people like Warren Buffett or George Soros, but there are few bloggers out there you can seek advice from (i.e. Anirudh Sethi Report )