German Dax up 1%. UK FTSE up 0.7%

The major indices in Europe are ending the day higher.

The provisional closes are showing:

- German Dax, up 1.09%

- France’s CAC up 0.93%

- UK FTSE up 0.43%

- Spain’s Ibex up 0.56%

- Italy’s FTSE MIB up 0.59%

Not only is it end of day, but also the end of week, end of month and 2Q. How did the major European indices perform in the month, quarter, and might as well add the year too.

For the week,

- German DAX, +0.48%

- France’s CAC, +0.2%

- UK’s FTSE, +0.24%

- Spain’s Ibex, -0.3%

- Italy’s FTSE MIB, -0.72%

For the month, the major European shares have solid gains:

- German DAX, +5.7%

- France’s CAC, +6.3%

- UK’s FTSE, +3.7%

- Spain’s Ibex, +2.3%

- Italy’s FTSE MIB, +7.2%

It is quarter end. the indices were higher with the exception of Spain and Italy which declined modestly

- German DAX, +7.57%

- France’s CAC, +3.52%

- UK’s FTSE, +2.0%

- Spain’s Ibex, -0.4%

- Italy’s FTSE MIB, -0.2%

Finally, for the year, the YTD numbers are showing solid gains:

- Germany’s DAX, +17.42%

- France’s, +17.09%

- UK’s FTSE, +10.37%

- Spain’s Ibex, +7.72%

- Italy’s FTSE MIB, +15.88%

How does the YTD compare to the US?

- Dow, up 14.01%

- S&P up 17.1%

- Nasdaq +20.54.

I can’t say my returns have been as stellar, but I gotta think that there are a lot of people, who may be underinvested in equities this year. As a result, if not all-in, that likely lessens the returns relative to the averages.

Am I right? How are you doing?

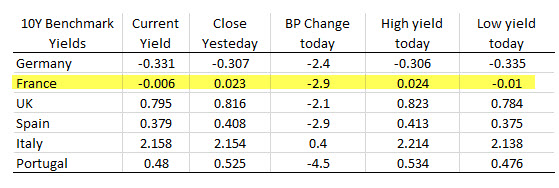

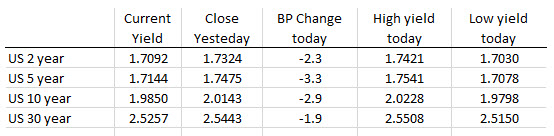

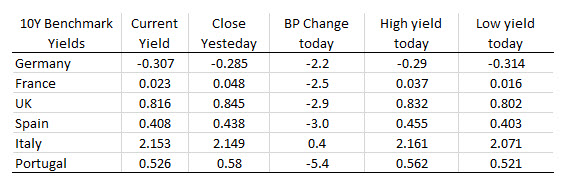

In other markets as London/European traders look to exit are showing:

In other markets as London/European traders look to exit are showing:

IN the forex market as London/European traders look to exit, the AUD is still the strongest and getting stronger since the US open). The USD has been overtaken by the JPY and GBP as the weakest of the majors on the day. The GBPUSD reached the highs from June (and peaked a little above those levels) but failed. The price rotated back down.

IN the forex market as London/European traders look to exit, the AUD is still the strongest and getting stronger since the US open). The USD has been overtaken by the JPY and GBP as the weakest of the majors on the day. The GBPUSD reached the highs from June (and peaked a little above those levels) but failed. The price rotated back down.