Closing changes for the main European bourses:

- UK FTSE -0.7%

- German DAX flat

- French CAC -0.1%

- Spain IBEX -0.3%

- Italy MIB -0.3%

- UK FTSE +0.4%

- German DAX +0.6%

- French CAC +0.2%

- Spain IBEX +1.1%

- Italy MIB +0.1%

The bias has turned more favourable in the most recent poll with a slim majority of respondents (53/102) viewing that risks to the outlook are now skewed more to the upside.

Japanese stocks push higher again today, helped by continued optimism in the US-China trade rhetoric with US officials claiming that a deal is “very close” now. And that is also helping to keep markets cautiously optimistic over the past few days.

Japanese stocks managed to find a reprieve to end the week but the overall mood remains more mixed as traders and investors are still caught in the middle of trying to figure out how US-China trade talks are developing at the moment.

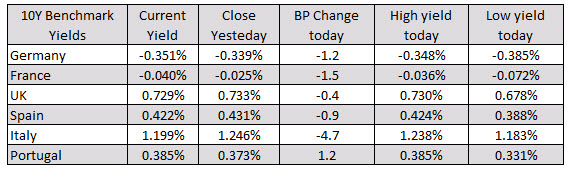

In the European debt market, the benchmark 10 year yields are ending mostly lower (the exception is the Portugal 10 year).

In other markets as European/London traders look to exit:

In other markets as European/London traders look to exit: