Asian equities climb as Wall Street snaps tech losing streak

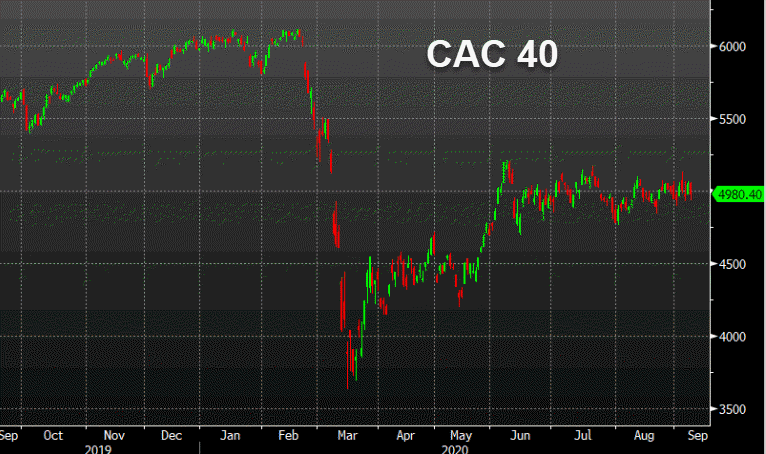

A more positive day for stocks in Asia, with the Hang Seng up 0.2% and the Shanghai Composite seen up by 0.5% as well. This comes on the back of a better performance by Wall Street yesterday, with the Nasdaq closing up by 2.7%.

That said, the losing streak may be ended for now but it is still too early to say if this is where everything returns back to sunshine and rainbows. US futures are keeping mildly higher, moving off earlier lows at least but are still more tepid in general.

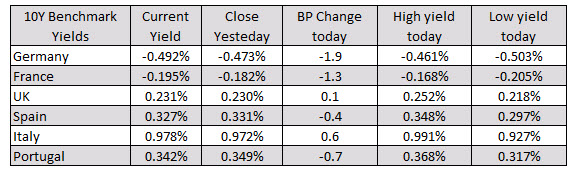

In the major currencies space, all eyes are on the euro today as we look towards the ECB policy meeting decision and Lagarde’s press conference to follow up on that.