Mixed results in Europe

The European indices are closing the session with mixed results. Provisional closes are showing:

- German DAX, -0.27%

- France’s CAC, +0.1%

- UK’s FTSE 100, +0.7%

- Spain’s Ibex, -0.5%

- Italy’s FTSE MIB, +0.1%

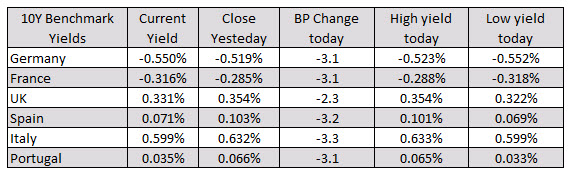

in the European debt market, the benchmark 10 year yields are also ending mixed with Germany, France, Spain marginally higher, while UK, Italy and Portugal are lower: