Real Mexican Peso

On top of: -Banking and housing bubbles -Interest rate imbalances -Shrinking current accounts

-Declining excess FX reserves -Communist corruption and oppression -Capital flight $USDHKD $USDCNY

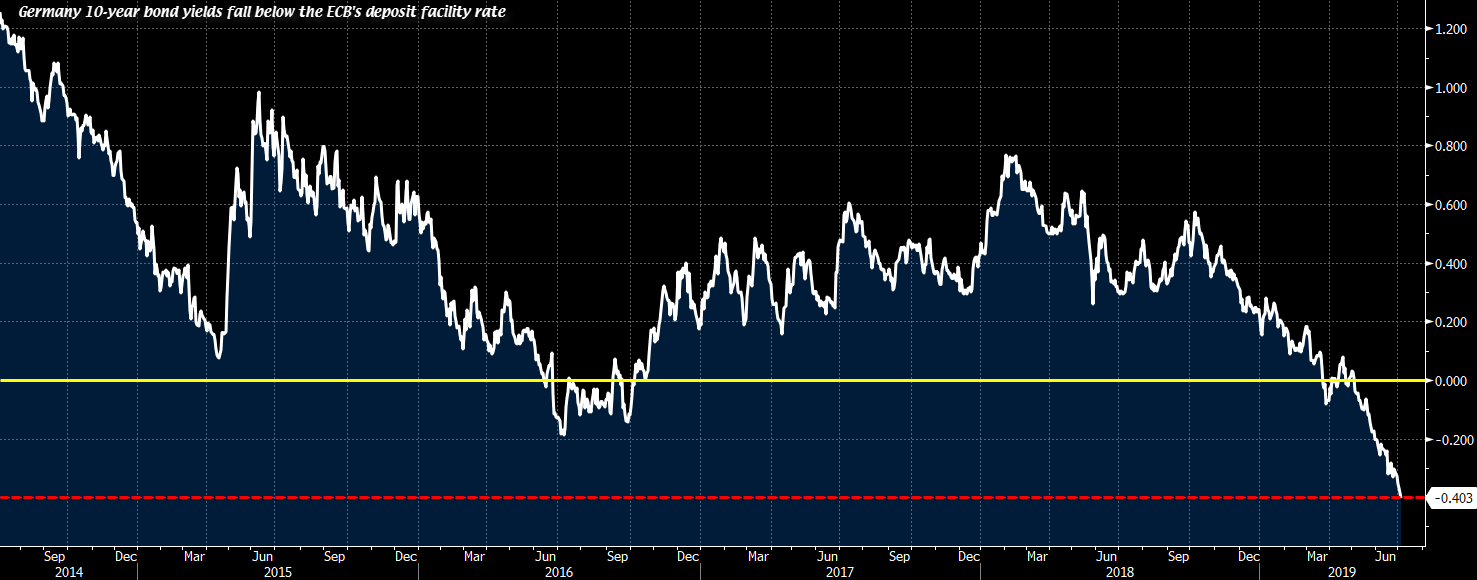

There isn’t much standing between it and a return to the lows. The fall today takes it below the 61.8% retracement of the June rally. On the USD side, the market is increasingly concerned that the Fed won’t cut as deeply as what’s priced into the market.