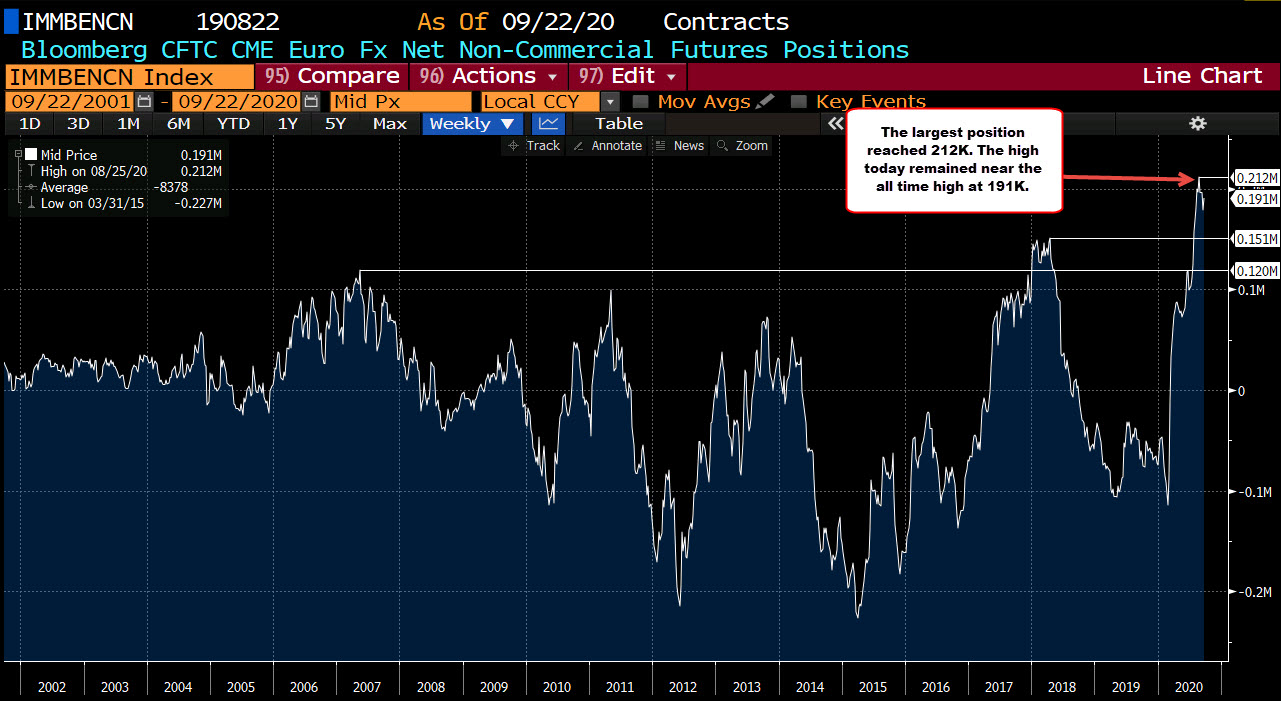

CFTC commitments of traders data for the week ending September 29, 2020

- EUR long 188K vs 191K long last week. Longs trimmed by 3K

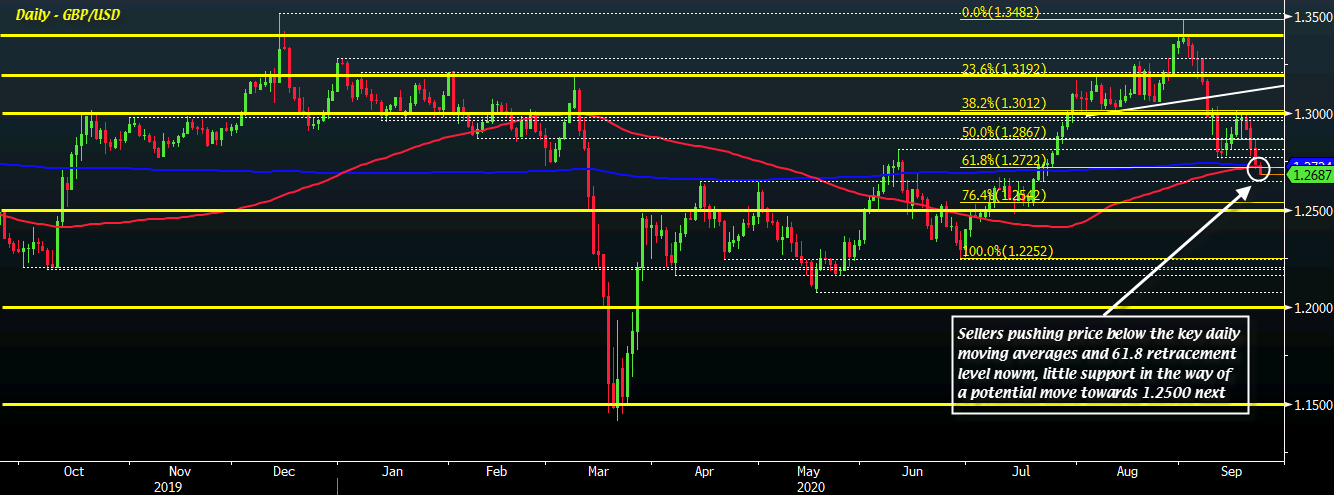

- GBP short 13K vs 3k long last week. Shorts increased by 16K

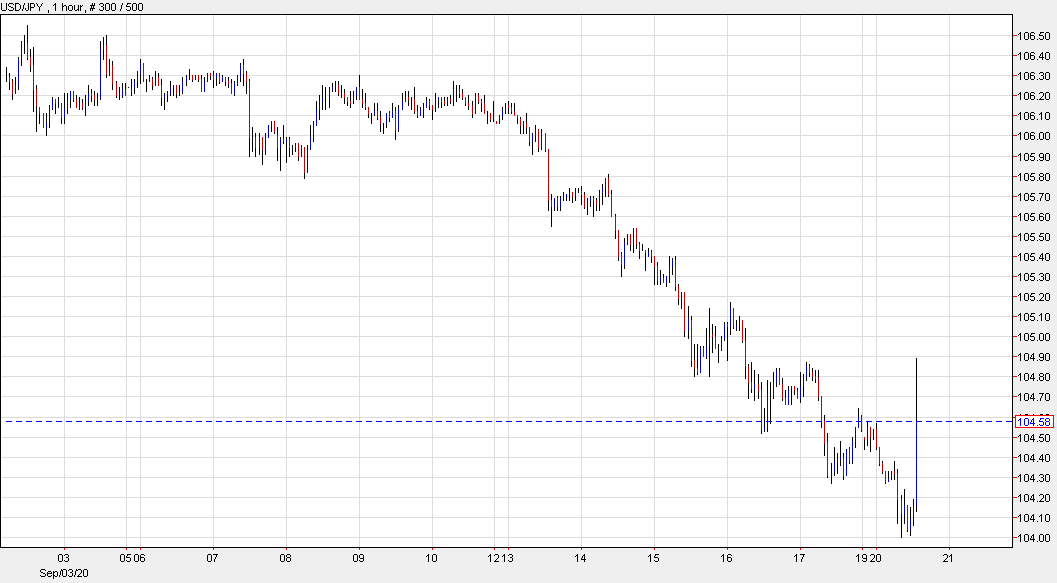

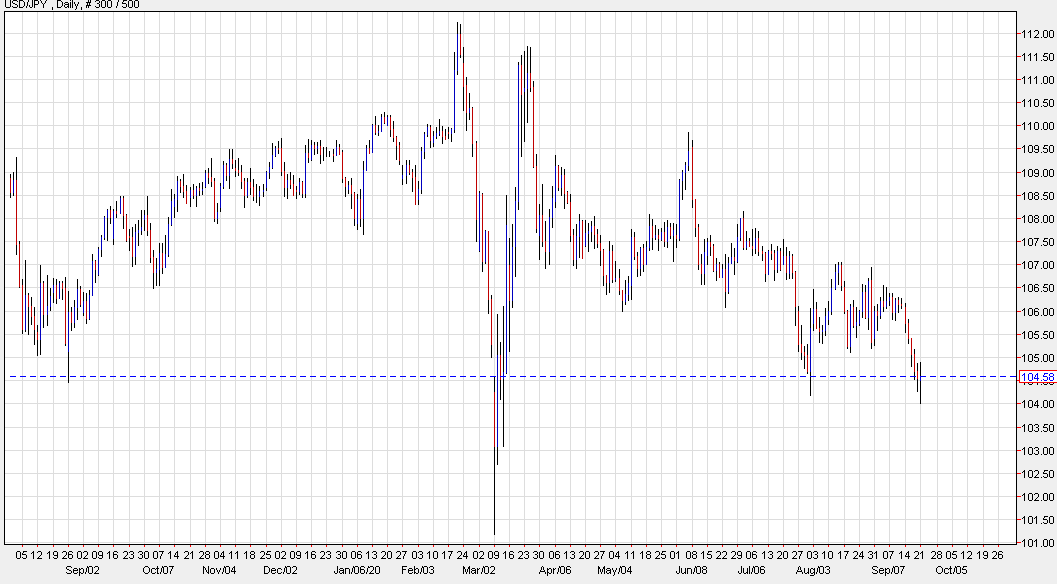

- JPY long 25K vs 30K long last week. Longs trimmed by 5K

- CHF long 13K vs 16K long last week. Longs trimmed by 3K

- AUD long 9K vs 16K long last week. Longs trimmed by 7K

- NZD long 3K vs 5K long last week. Longs trimmed by 2K

- CAD short 19k vs 19K short last week. Unchanged

- prior report

Highlights:

- The GBP position swung around from being long to short with a that 16K change in position .

- The EUR shorts remain the overwhelming largest speculative position at 188K.

- The NZD is the smallest net speculative position at long 3K

- The CAD and GBP are the only short positions (long USD positions).

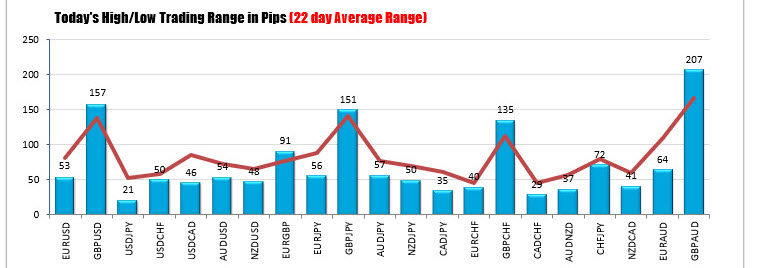

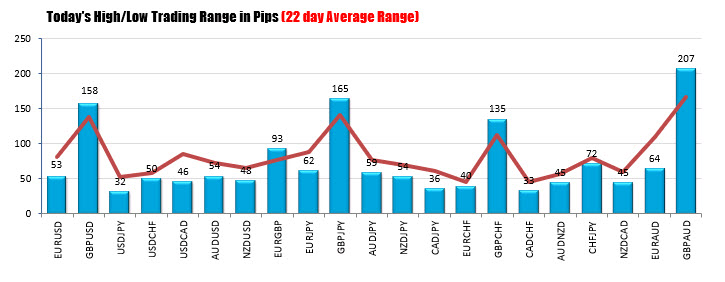

The major crosses are also little changed vs the early NY session.

The major crosses are also little changed vs the early NY session.