Good morning, afternoon or evening to all ForexLive traders and welcome to the start of the new FX week – the final one for 2020.

On a Monday morning, market liquidity is very thin until it improves as more Asian centres come online – and its even less liquid than usual today due to the holiday mode many liquidity providers are in.

Prices are liable to swing around on not too much at all, so take care out there.

Guide:

- EUR/USD 1.2188

- USD/JPY 103.56

- GBP/USD 1.3574

- USD/CHF 0.8883

- USD/CAD 1.2848

- AUD/USD 0.7601

- NZD/USD 0.7105

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

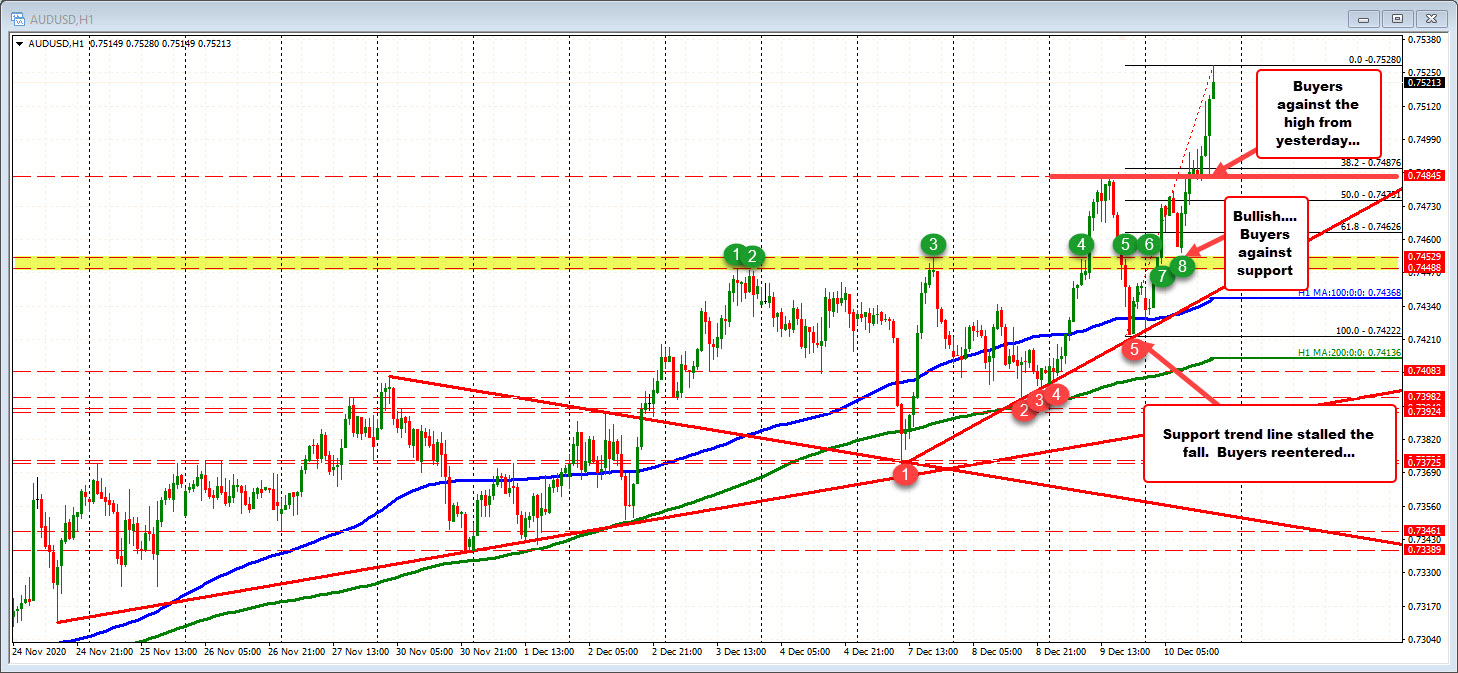

The buyers are making a breakout play on the daily (above 0.7483) and on the hourly chart as well (above 0.7448-53 and the high from yesterday at 0.7484. Stay above 0.7483 keeps the buyers in firm control. A move below that level could see more downside probing on the failure. The 0.7448-53 area is a key line in the sand for buyers now. Move below would not be welcomed.

The buyers are making a breakout play on the daily (above 0.7483) and on the hourly chart as well (above 0.7448-53 and the high from yesterday at 0.7484. Stay above 0.7483 keeps the buyers in firm control. A move below that level could see more downside probing on the failure. The 0.7448-53 area is a key line in the sand for buyers now. Move below would not be welcomed.