Archives of “Forex” category

rssFranc meltdown continues as risk tones keep calmer in European trading

EUR/CHF climbs to 1.1050 levels, nearing the October 2019 highs

The franc is the biggest loser on the week so far in the major currencies space and that owes somewhat to a breakout in EUR/CHF as the pair climbs to its highest levels since October 2019 today, nearing resistance at around 1.1059.

The meltdown in the franc over the past two days is also helped by the turnaround in sentiment with US equities rebounding strongly after Fed chair Powell’s testimony yesterday, and also as European investors are brushing aside the risk averse tones earlier.

Risk sentiment overall remains rather fragile but they are much improved at the moment as compared to Asian trading and the currency traders are running with that.

Another notable franc cross to watch is CAD/CHF as it extends a breakout from last week to fresh one-year highs – solidifying a break above the June 2020 high @ 0.7203.

Elsewhere, GBP/CHF has also posted a solid month of gains, trading up by ~700 pips in February as it nears 1.2900 and a test of long-term key resistance trendline:

With regards to franc sentiment, I’d still go back to EUR/CHF as the main driver but given the relative outperformance of the pound, GBP/CHF still has that going for it.

Hence, if EUR/CHF does break higher above 1.1059, it paves the way for further gains in franc crosses in the bigger picture, all things being equal that is.

Forex Update : #USD #EURUSD #USDJPY #GBPUSD #USDINR -Anirudh Sethi

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

To read more enter password and Unlock more engaging content

CFTC commitments of traders: Small changes and speculative positions. EUR remains the largest position

Weekly forex futures positioning data from the CFTC for the week ending Tuesday, February 16, 2021

- EUR long 140K vs 140K long last week. Unchanged

- GBP long 22K vs 21K long last week. Longs increased by 1K

- JPY long 37K vs 35K long last week. Longs increased by 2K

- CHF long 14K vs 11K long last week. Longs increased by 3K

- AUD short 3K vs 1K short last week. Shorts increased by 2K

- NZD long 12K vs 12K long last week. Longs trimmed by 3K

- CAD long 8K vs 10K long last week. Longs trimmed by 2K

- Last week’s report

- EUR long position of 140K remains the largest speculative position

- AUD short of 3K is the smallest speculative position and the only short

- The JPY long of 37K is the 2nd largest position

- The largest change this week was 3K (CHF and NZD)

US dollar strengthens after sizzling retail sales report

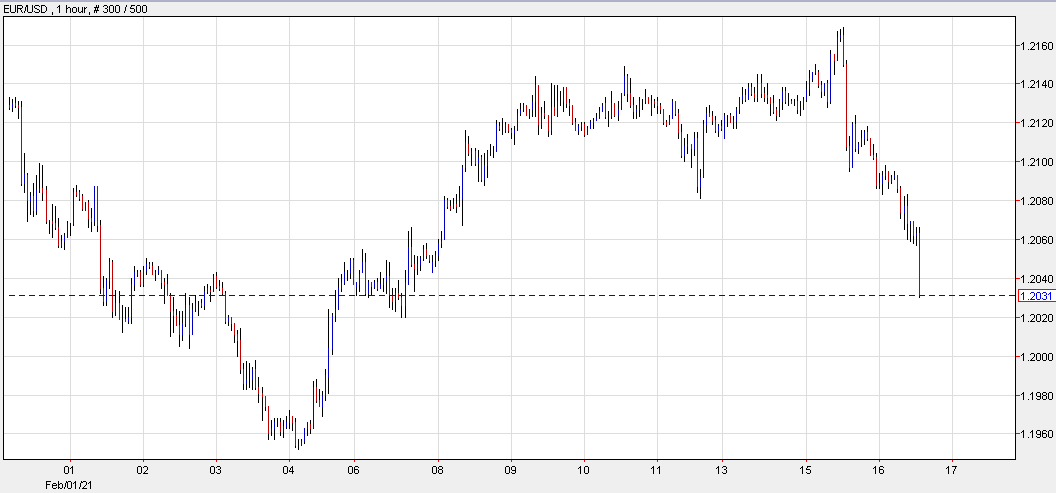

EUR/USD falls, near 1.20

The US dollar is near the best levels of the day right across the board after January retail sales rose 5.3%, blowing away expectations for a 1.1% gain.

EUR/USD has been a chief loser in the move, falling 30 pips to 1.2030. The pair hasn’t fallen below 1.20 since February 4.

Other moves are more-modest with the US dollar rising around a dozen pips.

The moves would be larger but there are some automatic stabilizers built into the market. The thinking is that strong data diminishes the need for fiscal stimulus from Congress. So while consumers are better off now, they might not be getting as much help later.

I think this doesn’t change the playbook for Congress so it’s ultimately going to be good for the dollar and equity futures, so long as the Fed doesn’t waiver in its belief that high spring/summer inflation will be temporary.

USD catches a fresh bid, EUR/USD now under 1.2100

Overnight moves carrying on further

- USD/JPY circa 106.20

- AUD/USD under 0.7740

- Cable losing ground also

- USD/CAD above 1.2700

- NZD/USD under 0.7200 (ps. the country has just reported two new cases of the virus in the community)

Rising US bond yields were pretty much ignored in Asia yesterday but they continued climbing and impacted during US time … the FX moves continuing now

Offshore yuan, CNH, gains further, to its highest since mid-2018

USD/CNH is losing ground as the yuan piles on more strength.

An Update : #USD #EURO #EURUSD #GBPUSD #USDJPY #AUDUSD #USDINR #GBPINR -#AnirudhSethi

To read more enter password and Unlock more engaging content

EUR/USD eases towards key near-term level as the dollar shows some fight

EUR/USD falls to 1.2105 and nears a test of its 100-hour moving average

The greenback is higher across the board in European morning trade and is starting to run against some key levels on the charts today.

Of note, EUR/USD is now down to near 1.2100 as price closes in on a test of the 100-hour moving average (red line) @ 1.2103.

Keep above that and the near-term bias stays more bullish but break below and the near-term bias becomes more neutral instead. Further key support is then seen closer to the 200-hour moving average (blue line) @ 1.2060.

If sellers can manage that, it essentially resets the upside momentum seen this week.

Elsewhere, the dollar is also putting up a decent showing with USD/JPY keeping a bounce from its 100-day moving average to 105.00 now – testing key levels. Meanwhile, AUD/USD is also falling to test its own 100-hour moving average @ 0.7726 currently.

USD/JPY falls to fresh one-week low as trouble brews for the dollar

USD/JPY falls to a low of 104.78, the lowest level in a week

Things are not looking good for the dollar as we are seeing USD/JPY reverse course after testing its 200-day moving average (blue line) since the latter stages of last week.

The upside momentum appears to have stalled and with yields retreating off the highs over the past few sessions, it is putting a drag on yen pairs in trading today.

Of note, USD/JPY is now down to 104.78 – its lowest level since 1 February.

The push below 105.00 is a significant one for sellers and even more so when you drill down to the near-term chart:

Sellers are now back in control upon a push below the 200-hour moving average (blue line) and are threatening a break below the 38.2 retracement level @ 104.84.

Further support is seen closer towards 104.55-61 but if this is the start of a turning point for the dollar, a return back to 103.50 to 104.00 isn’t out of the picture here.

As we navigate through the week, just keep an eye on the bond market as well in gauging sentiment for USD/JPY and yen pairs in general.