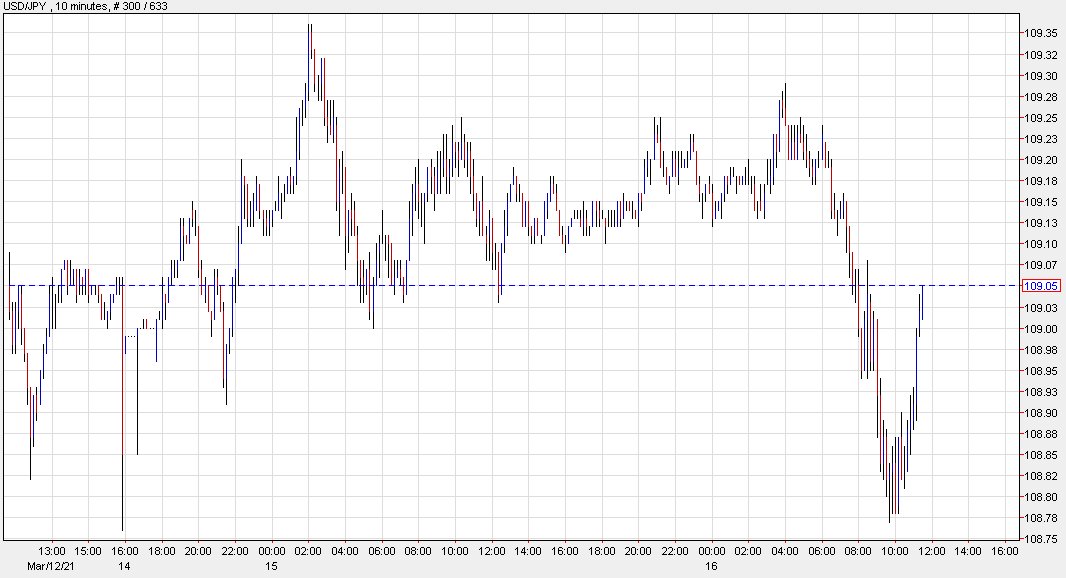

USD/JPY keeps little changed on the day after an initial spike higher

Was the BOJ more dovish or hawkish today? That’s a question that yen traders may not necessarily get the answer to in the immediate aftermath.

There were a couple of key takeaways from the policy decision, so let’s explore:

- BOJ removes ETF target purchases, but keeps ceiling of ¥12 trillion

- BOJ widens range of 10-year JGB yields fluctuation to +/- 0.25%

- Introduces interest scheme to mitigate side effects of cutting rates again, if needed

- Introduces fixed-rate purchase operations to prevent significant yields rise

- Judges that QQE and YCC are still appropriate policies to continue with

The first two points are arguably leaning more towards the hawkish side, though of the key takeaways above have already been communicated in the run up to the meeting via media leaks and reports over the past week or so.

However, the BOJ still judges that large scale ETF purchases are still effective in keeping the market more stable during times of “heightened instability”.

Meanwhile, this is also the first time that the BOJ has officially put the 10-year JGB yields band into its policy statement – before this it was just a verbal commitment.

The other remaining points lean more towards the dovish side, with the new interest scheme largely to try and convince the market that the BOJ does have room to cut rates further; after having been questioned persistently on the side effects of doing so.

As such, there is a mixture of elements in there for yen traders to work with. But ultimately, I reckon it’ll come down to how the JGB market may look to test the BOJ’s commitment of the 0.25% band above the 0% target.

Going back to the USD/JPY chart, traders look like they are still trying to make up their mind with Treasury yields also a key factor to watch out for.

Topside is limited around short-term resistance near 109.26-36 with the 200-week moving average @ 109.00 one to be mindful of ahead before the close today.

But overall price action continues to trade in and around the key hourly moving averages @ 108.90 and 109.07 respectively, with near-term support seen closer to 108.77 and also from yesterday’s low @ 108.63.

Those will be the key levels to watch in order to gauge how buyers or sellers are going to attempt to extend their bias in the pair ahead of the weekend.

Not forgetting that there is a decent-sized expiry ($840m) rolling off today at 109.00 as well. And just bear in mind that we are also approaching the fiscal year-end in Japan, though repatriation flows should arguably have been mostly done in the weeks prior.

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)