Archives of “Education” category

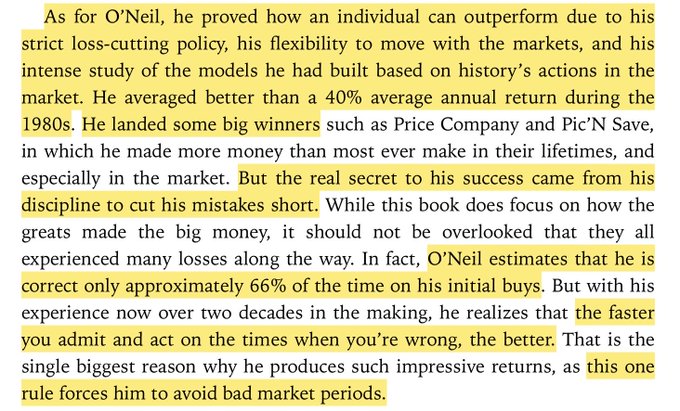

rssA few nice stats about O’Neil.

Since 1987, the wealth of the richest person in the world has increased at a rate of 6.4% per year.

A Winning Mindset is Required To Succeed

- A losing trader can do little to transform himself into a winning trader. A losing trader is not going to want to

transform himself. That’s the kind of thing winning traders do. - The winning traders have usually been winning at whatever field they are in for years.

- It is a happy circumstance that when nature gives us true burning desires, she also gives us the means to

satisfy them. Those who want to win and lack skill can get someone with skill to help them. - The “doing” part of trading is simple. You just pick up the phone and place orders. The “being” part is a bit more subtle. It’s like being an athlete. It’s commitment arid mission. To the committed, a world of support appears. All manner of unforeseen assistance materializes to support and propel the committed to meet grand destiny.

- In your recipe for success, don’t forget commitment – and a deep belief in the inevitability of your success.

The Trader and the Trading System Must Meet

- Systems don’t need to be changed. The trick is for a trader to develop a system with which he is compatible.

- My original system was very simple with hard-and-fast rules that didn’t allow for any deviations. I found it

difficult to stay with the system while disregarding my own feelings. I kept jumping on and off—often at just the wrong time. I thought I knew better than the system. - Also, it seemed a waste of my intellect and MIT education to just sit there and not try to figure out the markets.

- Eventually, as I became more confident of trading with the trend, and more able to ignore the news, I became more comfortable with the approach. Also, as I continued to incorporate more “expert trader rules,” my system became more compatible with my trading style.

- As I keep trading and learning, my system (that is the mechanical computer version of what I do) keeps evolving.

- Over time, I have become more mechanical, since (1) I have become more trusting of trend trading, and (2)

my mechanical programs have factored in more and more “tricks of the trade.” I still go through periods of thinking I can outperform my own system, but such excursions are often self-correcting through the process of losing money. - I don’t think traders can follow rules for very long unless they reflect their own trading style. Eventually, a breaking point is reached and the trader has to quit or change, or find a new set of rules he can follow. This seems to be part of the process of evolution and growth of a trader.

- A trading system is an agreement you make between yourself and the markets.

Hold Your Position Until the Trend is Invalidated, Do Not Let Go of Your Position. Be Willing to Experience Your Anxieties

- Maintaining a commitment is particularly important when it comes up for a test.

- Somewhere along the line of keeping your commitment you may get a feeling that you don’t like.

- If you are willing to experience the feeling, it can transform into an AHA that supports your commitment.

- If you are unwilling to experience the feeling, you might abandon your commitment to try to make the feeling go away. That only results in having to feel the feeling after all.

- The more you are willing to experience the feeling of bumping into walls, the less you have to bump into walls.

- Trading requires skill at reading the markets and at managing your own anxieties.

- People have a Conscious Mind and Fred. Fred wants to communicate feelings to CM so CM can experience them and gain experience and share it with Fred so Fred can learn how to react. This is how we manufacture wisdom. When we don’t like our feelings we tie them in k-nots and do not experience them. This interrupts the wisdom manufacture process, and draws drama into our lives.

- K-nots, protect us from truth and keep our lives in drama. To untie k-nots, fully experience whatever appears in the moment.

- When you keep your eye on the prize and are willing to experience all the feelings that arise, the prize soon becomes yours.

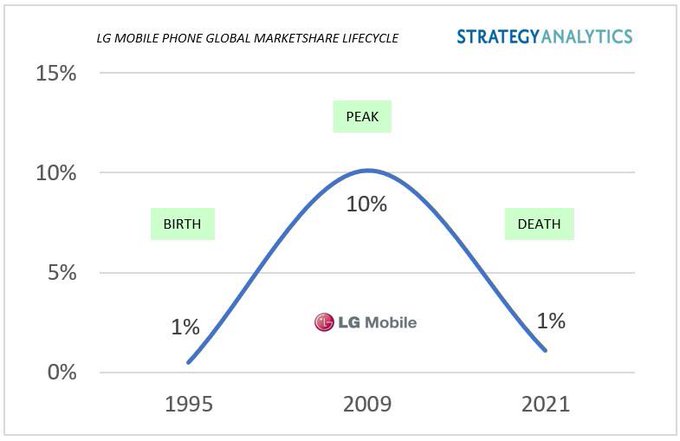

Goodbye LG’s #smartphone. Today marks the day LG will be exiting it’s money losing mobile business. Disappointed face

Ray Dalio on Focus

- You can have virtually anything you want, but you can’t have everything you want.

- Life is like a giant smorgasbord of more delicious alternatives than you can ever hope to taste. So you have to reject having some things you want in order to get other things you want more.

- Some people fail at this point, afraid to reject a good alternative for fear that the loss will deprive them of some essential ingredient to their personal happiness. As a result, they pursue too many goals at the same time, achieving few or none of them.

- In other words, you can have an enormous amount: much, much more than what you need to have for a happy life. So don’t get discouraged by not being able to have everything you want, and for God’s sake, don’t be paralyzed by the choices. That’s nonsensical and unproductive. Get on with making your choices.