Archives of “Education” category

rssA few things intelligent fanatics have in common:

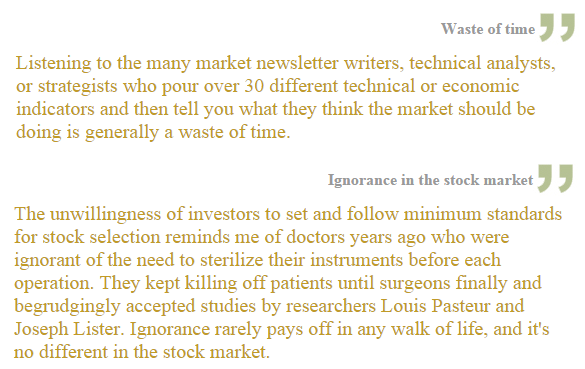

Couple favorite O'Neil quotes

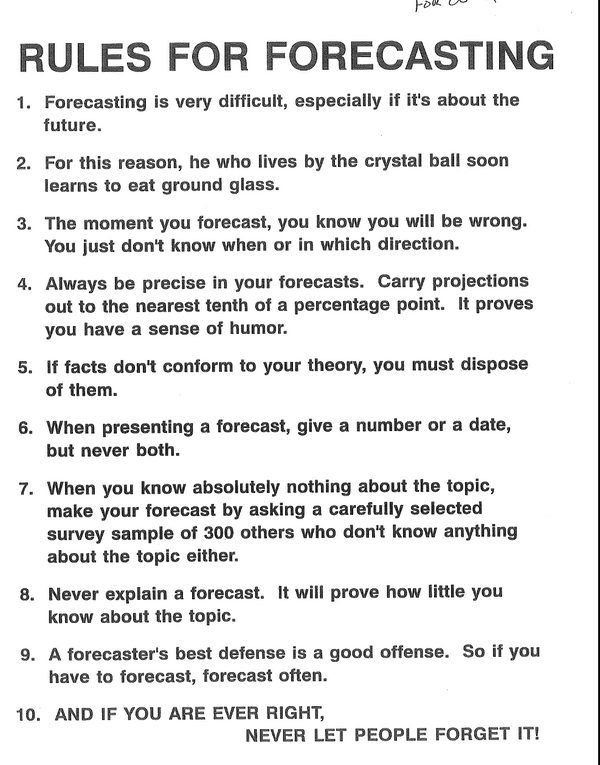

10 Rules For Forecasting

You will never be a profitable trader without

28 questions that every trader should answer honestly…

Do you know your Art of Trading

Do you have a trading plan

Do you think in terms of probabilities

Do you know which time frame fits your psychology

Do you cut your losses

Do you define your Risk

Do you add to your losing Position (more…)

Avoid complexity in your trading. Do not use many too indicators simultaneously.

Great Strategy For Traders

In Reminiscences of a Stock Operator there is a scene where a tout runs up the the Commodore and says buy such and such stock. The Commodore phones his broker and says sell 10K, then says sell 10 more. Tout goes, “What are you doing, I said Buy!, not sell”. Commodore says, I need to see how the market is taking the orders.

In Reminiscences of a Stock Operator there is a scene where a tout runs up the the Commodore and says buy such and such stock. The Commodore phones his broker and says sell 10K, then says sell 10 more. Tout goes, “What are you doing, I said Buy!, not sell”. Commodore says, I need to see how the market is taking the orders.

Does it make a difference how your orders are being filled? Are they gobbled as price passes thru as if you weren’t even there, or does it nibble nibble at the order and partially fill, or does it touch and fill, or does it sit on price touch, touch, not fill, then fill? Do these variations even make a predictive difference in what happens in the near future?

Decoding Mutual Fund Brochures

Rules for Bear Market

1. Good news in a bear market is like smoke in the breeze (i.e., soon dispersed). Don’t buy into upgrades or analyst recommendations. Analyst “upgrades” or recommendations can kill you.Every person reading this has access to some kind of trading platform, trading tools or systems that afford instant access to the financial markets. Good news like upgrades in bear markets typically has about five minutes of fame.

1. Good news in a bear market is like smoke in the breeze (i.e., soon dispersed). Don’t buy into upgrades or analyst recommendations. Analyst “upgrades” or recommendations can kill you.Every person reading this has access to some kind of trading platform, trading tools or systems that afford instant access to the financial markets. Good news like upgrades in bear markets typically has about five minutes of fame.

2. Bear markets are not a time to learn how to “day trade” in an effort to recoup losses (no matter how many times you hear that “this is a traders’ market”).

3. Accumulation days (there may be three or more in a row) are shorting opportunities, but resist being aggressive until the S&P 500 shows a 3- and 5-day moving average bearish cross. (Remember that it’s 50% market, 25% sector and 25% stock as far as direction, but some could argue in markets it’s 75% index, 15% sector and 10% stock.)

4. Chart patterns (unlike ice cream) come in just two flavors: continuations and reversals. Reversal patterns mostly form in weak trends. If the trend that the market or stock you are watching has been strong, then chances are that any pause is just a consolidation before the next leg down.

5. There is no such thing as “safe sectors.” Sure, each bear market brings sector rotation. But make sure if you are playing this game that you don’t have the flexibility of wood. And when the music stops, quickly find a chair!

That is, you must keep a flexible mindset so that you are able to change with the markets. The best traders are those who are nimble and approach the markets without bias.

6. Your stop-losses are YOUR stop-losses. The pain of being down 8% in a bull market is no different than being 8% wrong in a bear. If your risk tolerance requires you stopping out at 8%, then be consistent in any market you trade, but trade “with the primary trend.”

It takes greater emotional balance to trade a bear than a bull. So, always manage your risk — just remember that, in the markets, your money is always at risk.

Great traders manage emotions and risk. This makes them great. YOU know your risk tolerance and YOU control what happens between the “keyboard and chair.”

7. Bear markets are generally slow-moving affairs. However, stocks in bear markets can move much faster than you think (hence the reason that volatility rises drastically). But the “time” we spend in a bear is what everyone needs to keep in perspective. Bear markets last much longer than most are willing to wait. (more…)