Trading isn’t easy, but the difficulty of it shouldn’t be underestimated. The markets are a psychological battleground, and successful traders are those who understand and use this to their advantage.

Whether you’re new to trading or an experienced investor, you will face challenges when playing the market. You need to be prepared for these difficulties and know how to navigate them in order to come out on top. After all, with so much influence from outside parties — from news headlines to your friends — the market is anything but straightforward.

If you want to succeed as a trader, you have to understand what makes others fail. To succeed as a trader requires fortitude, focus, and discipline that few can claim they have in abundance. It’s not just about knowing technical analysis or reading charts; it’s about understanding human psychology and using that knowledge against them when necessary.

Archives of “Education” category

rssAn Update : #GOLD #SILVER #PALLADIUM #PLATINUM —-#AnirudhSethi

To read more enter password and Unlock more engaging content

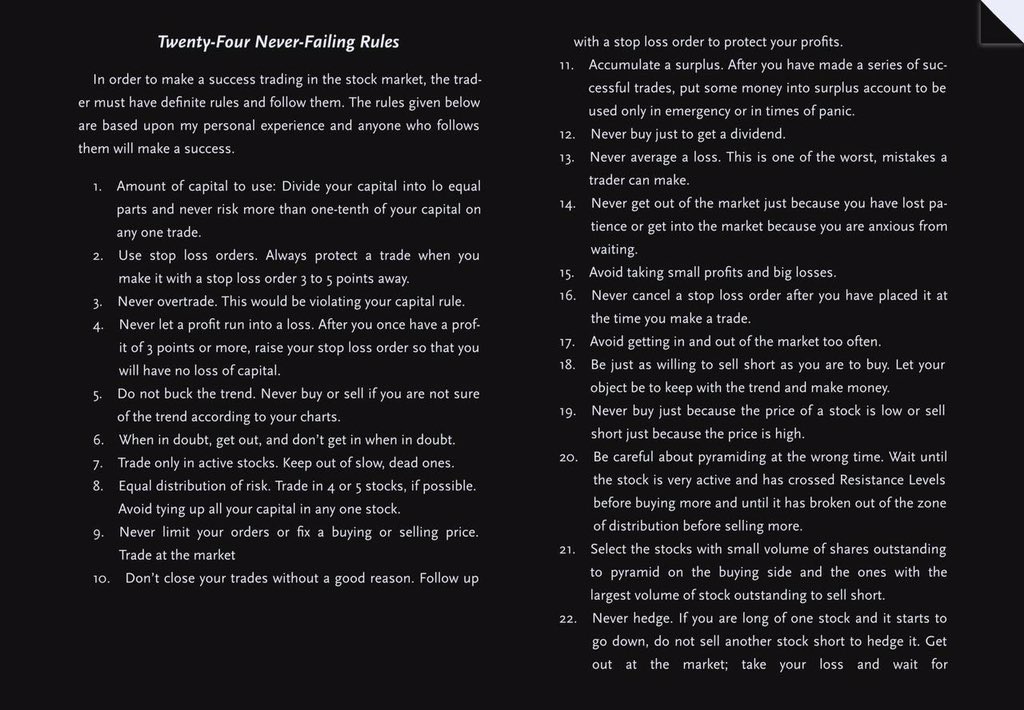

WD Gann’s 24 Never failing rukes

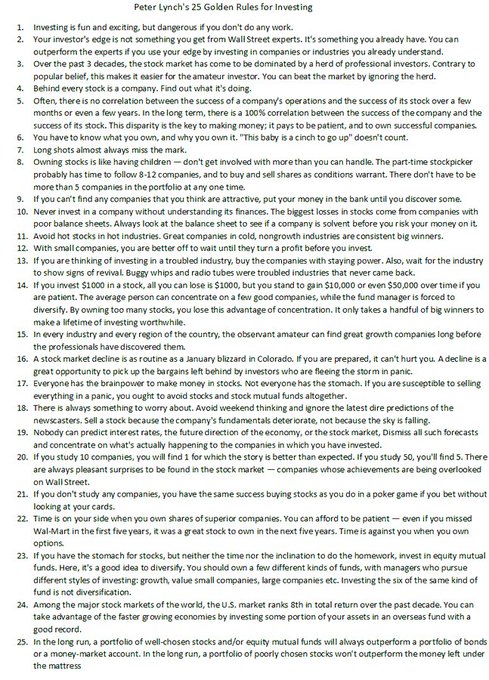

25 Golden Rules by Peter Lynch

Patience in #Trading —#AnirudhSethi

It is true that you may not become wealthy in the next couple of months or years if you just began. However, if you maintain the proper mindset and attitude, you will eventually see a piece of that success.

It is true that you may not become wealthy in the next couple of months or years if you just began. However, if you maintain the proper mindset and attitude, you will eventually see a piece of that success.

Having patience is all about trading.

It is unfortunate but true that you will not become wealthy immediately, or even in the next few years if you are just beginning. However, if you maintain the proper mindset and attitude, you will eventually see a portion of that accomplishment.

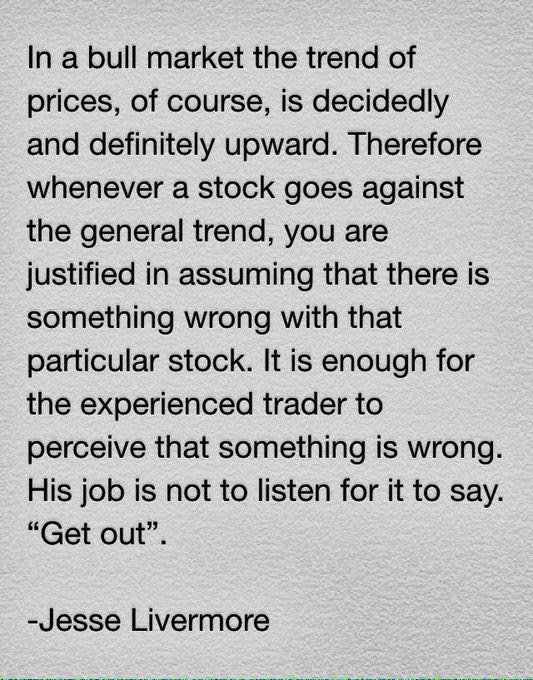

Whenever a stock goes against the general trend, you’re assuming if there’s something wrong w/ that particular stock.

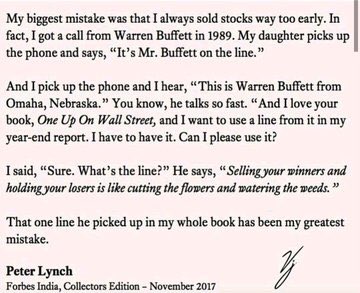

Peter Lynch with Warren Buffet

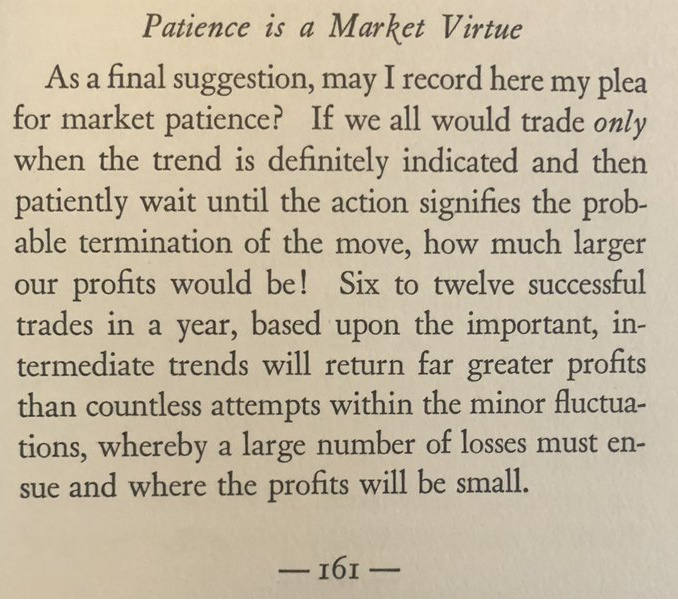

From ‘Tape Reading and Market Tactics’ – Humphrey Neill 1931

From that classic book from 99 years ago – basically, don’t drive on the wrong side of the road.

Why Day Trader is having an EGO ? – #AnirudhSethi

Day Traders are known as the EGO traders because they have Extreme Greed or Extreme Fear or both. Either way, they have an EGO problem and it’t not good for your trading account. The Ego is a universal human trait that we all share to some extent, but in the world of day trading it can be your worst enemy. When you get caught up in the ups and downs of being a trader, your ego can get in the way of making smart decisions about when to buy and sell stocks. The ego creates this friction between what we know logically as a trader should be doing and how we want to do things. In other words “Know thyself” is the best advice for a day trader. Let’s see why Day Trader has an EGO now: Extreme fear is the emotion that makes you want to exit a trade as soon as you get in. It causes you to be impulsive and want to sell before the trade has a chance to work itself out. While extreme fear may seem like a good thing, as it can prevent you from being greedy and losing money, it can also prevent you from making money. Greed and fear are two sides of the same coin, they feed off each other and can have a devastating effect on your trading account. The best way to deal with the two emotions is to know when they are getting the best of you. You must learn to stay objective and calm in the face of these emotions.

Extreme fear is the emotion that makes you want to exit a trade as soon as you get in. It causes you to be impulsive and want to sell before the trade has a chance to work itself out. While extreme fear may seem like a good thing, as it can prevent you from being greedy and losing money, it can also prevent you from making money. Greed and fear are two sides of the same coin, they feed off each other and can have a devastating effect on your trading account. The best way to deal with the two emotions is to know when they are getting the best of you. You must learn to stay objective and calm in the face of these emotions.

Extreme Greed

Extreme greed is the number one enemy for day traders. It is the emotion that causes you to hold on to a stock and ride it up, up and up. It makes you think that once you get back to even on the trade, you will be able to sell and make a profit. You know that the stock is moving up, but you are so focused on getting back to even, you don’t pay attention to the signs that tell you the stock is peaking. The greed trap makes you think that if you get out now, you will miss out on the big profits that you know are just around the corner. Extreme greed is the emotion that keeps you in a losing position until it is too late.Extreme Fear

Extreme fear is the emotion that makes you want to exit a trade as soon as you get in. It causes you to be impulsive and want to sell before the trade has a chance to work itself out. While extreme fear may seem like a good thing, as it can prevent you from being greedy and losing money, it can also prevent you from making money. Greed and fear are two sides of the same coin, they feed off each other and can have a devastating effect on your trading account. The best way to deal with the two emotions is to know when they are getting the best of you. You must learn to stay objective and calm in the face of these emotions.

Extreme fear is the emotion that makes you want to exit a trade as soon as you get in. It causes you to be impulsive and want to sell before the trade has a chance to work itself out. While extreme fear may seem like a good thing, as it can prevent you from being greedy and losing money, it can also prevent you from making money. Greed and fear are two sides of the same coin, they feed off each other and can have a devastating effect on your trading account. The best way to deal with the two emotions is to know when they are getting the best of you. You must learn to stay objective and calm in the face of these emotions.