Archives of “Education” category

rssThe three stages to becoming a successful trader

- Your ability to execute your trades is a function of the amount of fear you generate or the lack of it. Fear is always the result of your beliefs about the threating nature of the environment.

- Essentially, what you fear is not the markets but rather your inability to do what you need to do, when you need to do it, without the hesitation.

- If you can’t execute your trades properly, even when you perceive the most perfect opportunity, it is because you have not released yourself from the pain contained in the memories of past trading experiences and because you still don’t trust yourself to act appropriately in any given set of conditions.

- You were either immobilized by the fear of failure or you are struggling with a belief (value) system that say you don’t deserve the money. Otherwise, you would have acted on your perception.

APEC CHINA 2014

Success, it's More than you Think!

Two Facts

Iam tracking Indian Stock Market and Global Market since 1992.Yes after 17 years ..I had seen these are two real facts of Trading.

#1: Small-range market periods lead to large-range market periods. Low volatility breeds high volatility, which in turn leads to low volatility.

Just about the time everyone is resigned that market conditions will never change is exactly when conditions will change.

#2: Trading is a business where you can never be right. Never. No matter what we do, our mistakes will always outnumber our correct decisions. That’s why grading ourselves on every minute` decision will come up with more of a batting average score than college test score.

Mistakes can always outnumber correct actions… so long as correct actions outweigh mistakes. It ain’t the size of our right or wrong actions that counts: it’s how much they weigh in $$ values. Size does matter.

The great news is, as traders we never have to be perfect. We don’t even have to be 50% perfect. We only need to maximize our wins and minimize our losses. And we only need to win once per day, more days than not to be good. Just barely profitable = the top ten percentile of our profession. Anything beyond that is outperforming 90% of the field.

Tolstoy on his quest for the meaning of life

Extreme hair

Better to be Born Rich Than Talented…

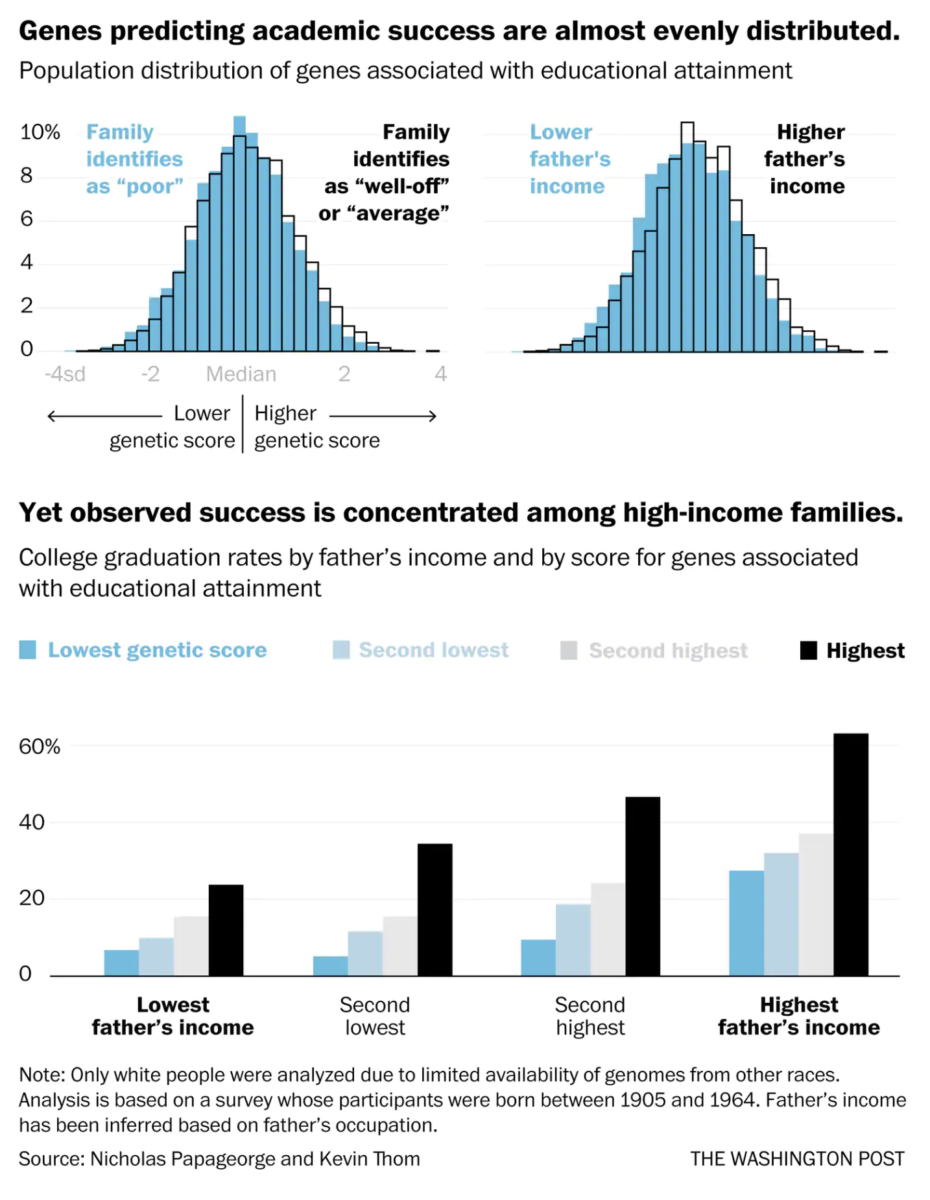

This is a fascinating graphic, and of the analysis is correct, we have radically overstated if the American Dream is alive and well in this country:

A revolution in genomics is creeping into economics. It allows us to say something we might have suspected, but could never confirm: money trumps genes.

Using one new, genome-based measure, economists found genetic endowments are distributed almost equally among children in low-income and high-income families. Success is not.

The least-gifted children of high-income parents graduate from college at higher rates than the most-gifted children of low-income parents.”

On my desk, Curtis M Faith-Inside the Mind of the Turtles

THIS. IS. BRILLIANT.