Identify the Universe

Rank all potential markets by a smoothed rate of change

Smoothed ROC = Average of [ ROC(Close, 2-day), ROC(Close, 5-day), ROC(Close, 7-day) ]

For stocks

Use the IBD50 and rank the stocks within this group by the smoothed ROC.

Also look at 52-week new highs and new lows, and all-time new highs and new lows

Look to buy the strongest markets and sell the weakest markets, with the hope that they will continue to trend.

Look for a Trend Breakout

Breakout long

Buy the X day high and sell the Y day low (e.g. for the turtles, X = 20, Y = 10)

MACD (not the histogram) must be above zero and increasing.

Breakout short

Short the X day low and cover the Y day high.

MACD must be below zero and decreasing.

Risk Management Rules

Risk per trade

Risk no more than 0.75% to 1.25% of your core equity in one trade (equity of all closed positions and cash positions, excluding open trade equity)

Risk per sector

No more than 5% of total account size in any sector.

Open trade risk

The more open trade risk, the more potential for increased drawdowns. Your biggest drawdowns will probably be after one of your biggest run ups.

Total open trade equity / Core equity <= 20%

Margin to equity

Higher the margin to equity, the more positions and more risk

Margin / equity <= 15%

Dollar risk per contract

No more than $2,500 risk per contract regardless of account size

Markets in each direction

No more than 10 markets on the long side; and

No more than 10 markets on the short side

For stocks

Don’t short a stock below $20

Don’t buy a stock under $10

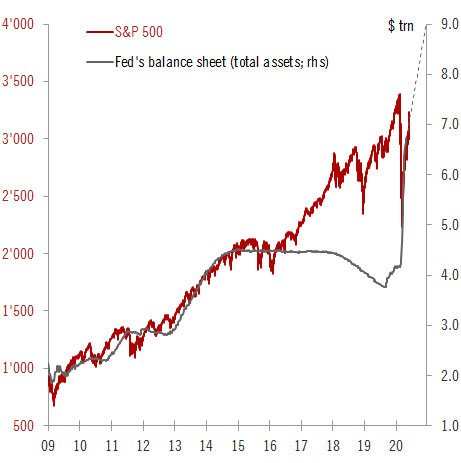

Look to go long S&P 500 when it is above 200-day EMA

Look to go short S&P 500 when it is below 200-day EMA

Apply Stops

Initial stop

Long: Y-period low

Short: Y-period high

Trailing stop

39-period ATR trailing stop