- An earnest young newsman went up to Jesse Livermore one day and asked if he felt it was worthwhile to become a millionaire, considering all the strife and struggle one had to go through to get there. Livermore responded that he liked money a lot, so it was certainly worthwhile to him. But aren’t there nights when a stock trader can’t sleep? the reporter pursued. Is life worth living when you’re worried all the time?

- “Well now, kid, I’ll tell you,” Livermore said. “Every occupation has its aches and pains. If you keep bees, you get stung. Me, I get worried. It’s either that or stay poor. If I’ve got a choice between worried and poor, I’ll take worried anytime.”

- Livermore admitted that he worried about his speculations all the time, even in his sleep. But hen he said that was all right by him. “It’s the way I want it,” he said. “I don’t think I’d enjoy life half as much if I always knew how rich I was going to be tomorrow.”

Archives of “Education” category

rssFirst be consistent with smaller size,then slowly increase ur size.

Quit Bad Habits

Lower Size if doing poorly

Losses Must Hurt But Avoid Snowball Scenarios

- The people who survive avoid snowball scenarios in which bad trades cause them to become emotionally destabilized and make more bad trades. They are also able to feel the pain of losing. If you don’t feel the pain of a loss, then you’re in the same position as those unfortunate people who have no pain sensors. If they leave their hand on a hot stove, it will burn off. There is no way to survive in the world without pain. Similarly, in the markets, if the losses don’t hurt, your financial survival is tenuous.

- I know of a few multimillionaires who started trading with inherited wealth. In each case, they lost it all because they didn’t feel the pain when they were losing. In those formative first few years of trading, they felt they could afford to lose. You’re much better off going into the market on a shoestring, feeling that you can’t afford to lose. I’d rather bet on somebody starting out with a few thousand dollars than on somebody who came in with millions.

Do Not Override Your System During the Trading Day

- You should try to express your enthusiasm and ingenuity by doing research at night, not by overriding your system during the day.

- Overriding is something you should do only in unexpected circumstances – and then only with great forethought. If you find yourself overriding routinely, it’s a sure sign that there’s something that you want in the system that hasn’t been included.

- You can be creative in research but don’t trade creatively; in other words, stick to your systems.

- If your trading system is inadequate, you shouldn’t use it. If your system is good, then stick to it faithfully.

- In the meantime search vigorously for improvement. When the new system is ready you can change to it – you are not thereby failing to stick to your system. So there need be no conflict between persistence and change.

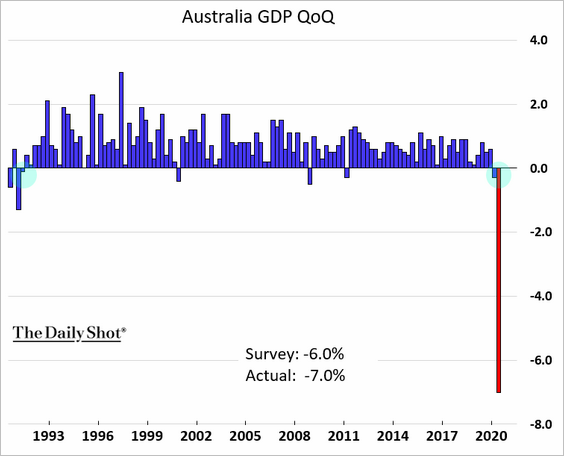

Australia’s First Recession in 28 Years