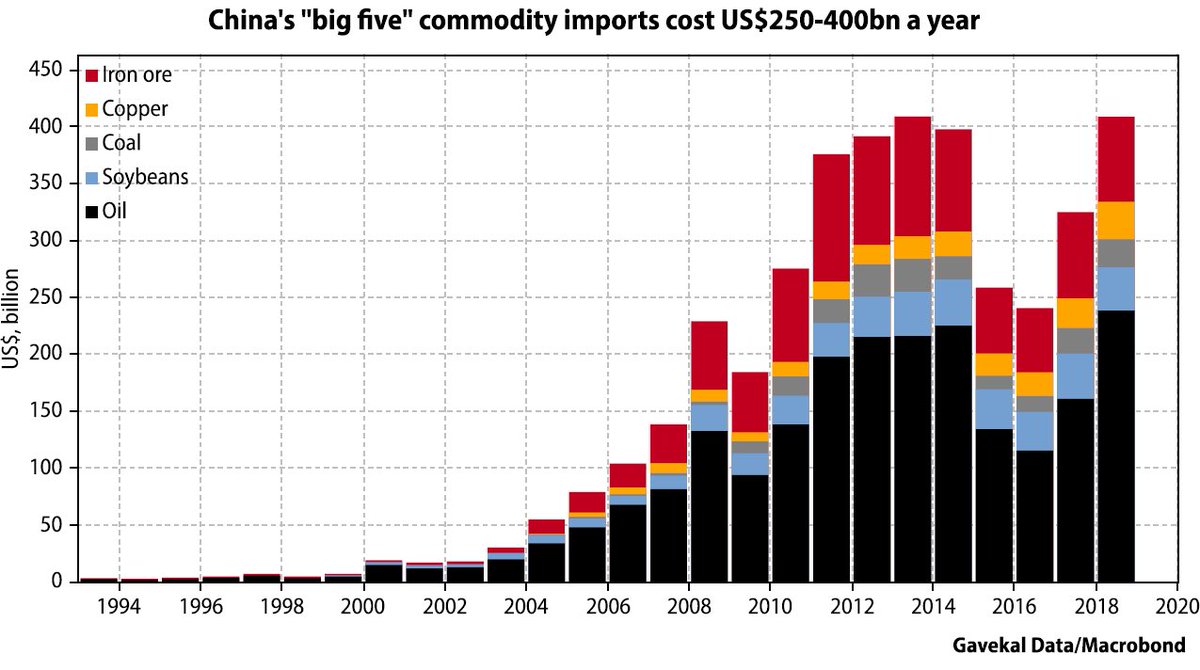

Unless US and China can strike a trade deal (and soon), the outlook remains bleak for the global economy

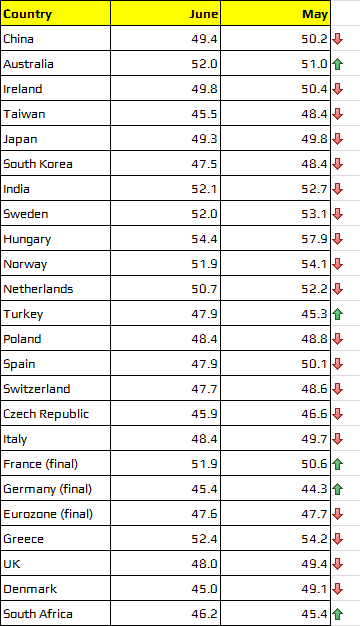

The above highlights the June manufacturing PMI releases from today and you can easily spot a theme that we’re seeing worsening conditions globally. Even if you factor in releases from Southeast Asian i.e. Malaysia, Indonesia, Philippines, they’re mostly also lower and showing the same trend as per the above.

Despite some improvements in Germany, Turkey and South Africa, all three readings are still in contraction territory and aren’t providing any indication of any significant improvement in manufacturing activity in the coming months.

So, a trade truce may be good on paper but what the world really needs is a trade deal and less tensions. Otherwise, it’s hard to gather much optimism from the weekend when you start looking at the bigger picture.