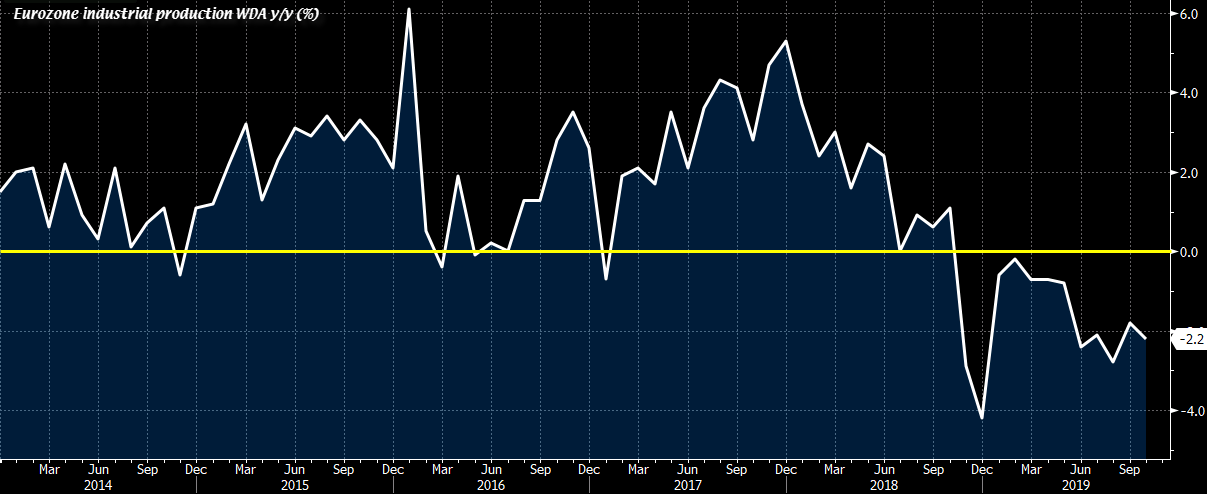

Latest data released by Eurostat – 12 December 2019

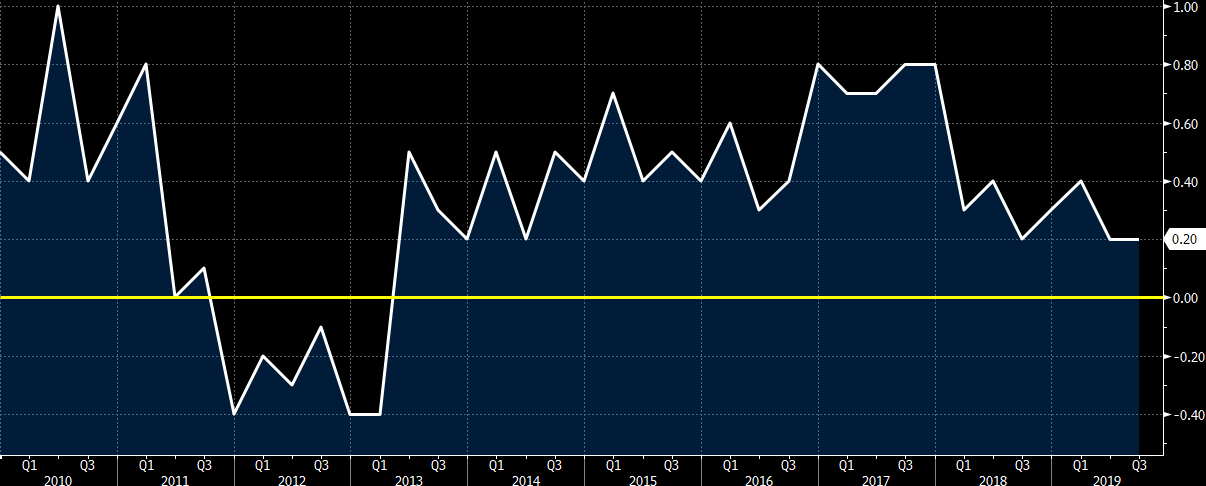

- Prior +0.1%; revised to -0.1%

- Industrial production WDA -2.2% vs -2.4% y/y expected

- Prior -1.7%; revised to -1.8%

Factory activity is seen slumping to start Q4 and that largely mirrors the weaker sentiment seen in the German industrial sector as well. This just reaffirms the added sluggishness in the manufacturing side of things in the euro area economy towards the end of the year.