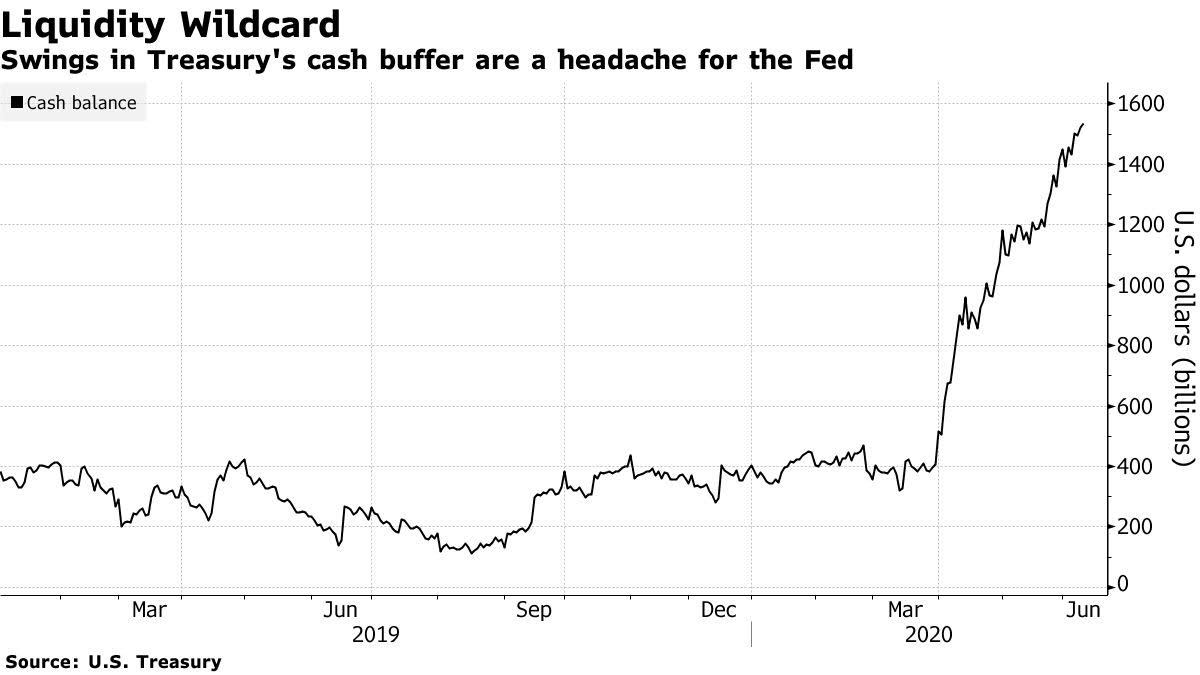

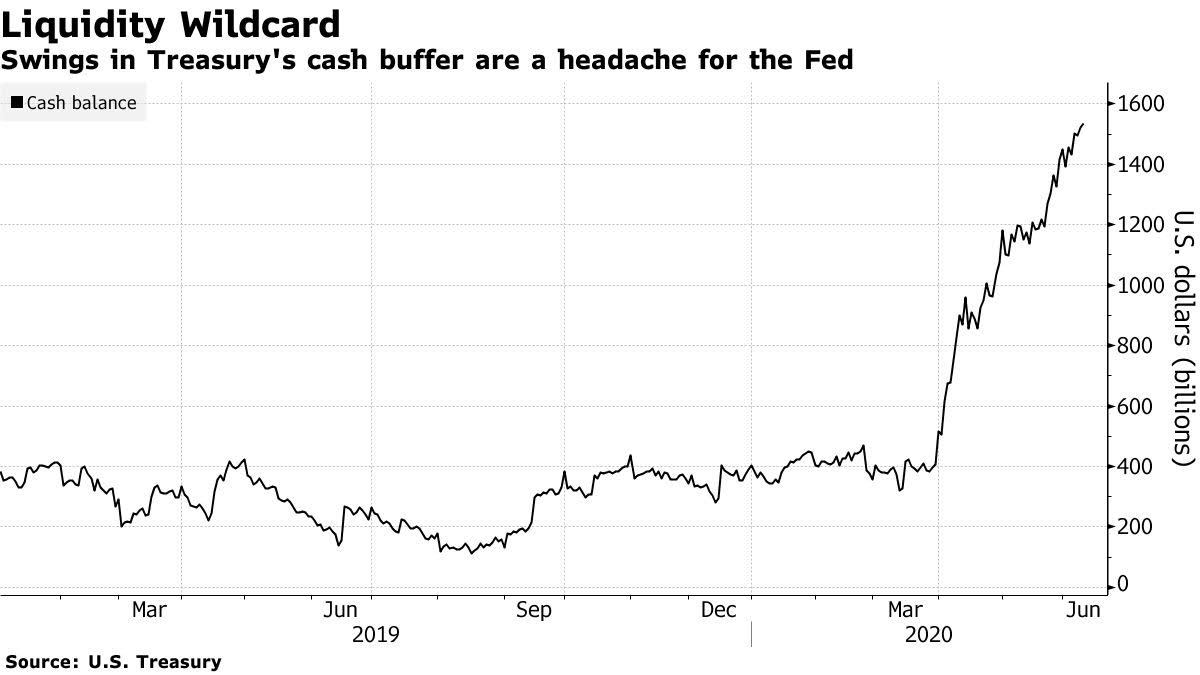

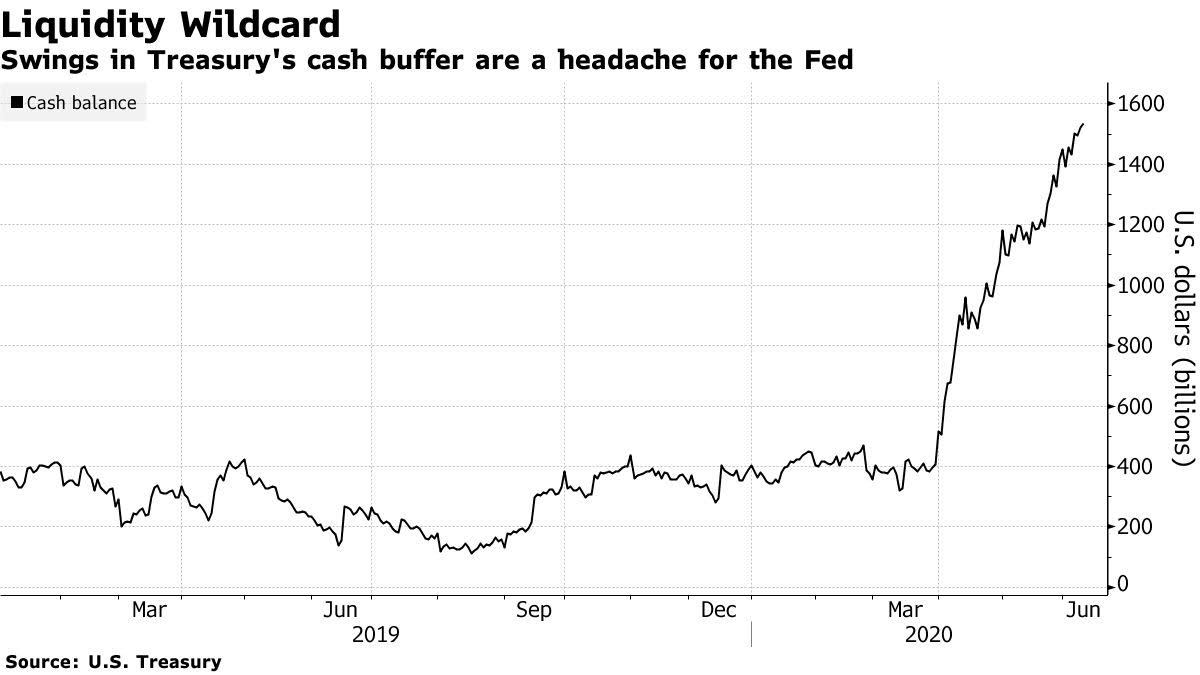

Treasury’s Record Cash Pile Is Jerome Powell’s $700 Billion Headache

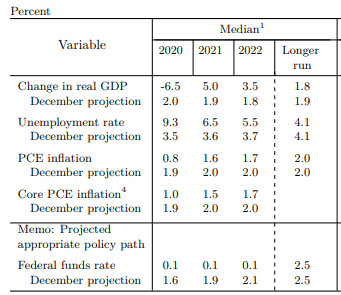

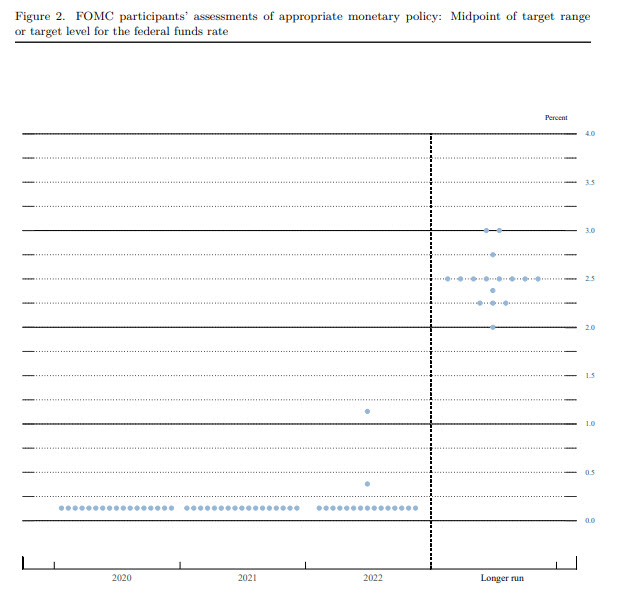

The last time the central tendencies and dot plot was released was way back in December 2019. At that time, the world was different place.

This compares to the early March forecast here, which is long outdated considering the coronavirus developments across the globe since then.

PPI -3.7% y/y … deeper deflation

In determining the date of the monthly peak, the committee considers a number of indicators of employment and production. The committee normally views the payroll employment measure, which is based on a large survey of employers, as the most reliable comprehensive estimate of employment. This series reached a clear peak in February.