Latest data released by Markit – 23 October 2020

- Prior 53.7

- Services PMI 46.2 v 47.0 expected

- Prior 48.0

- Composite PMI 49.4 vs 49.2 expected

- Prior 50.4

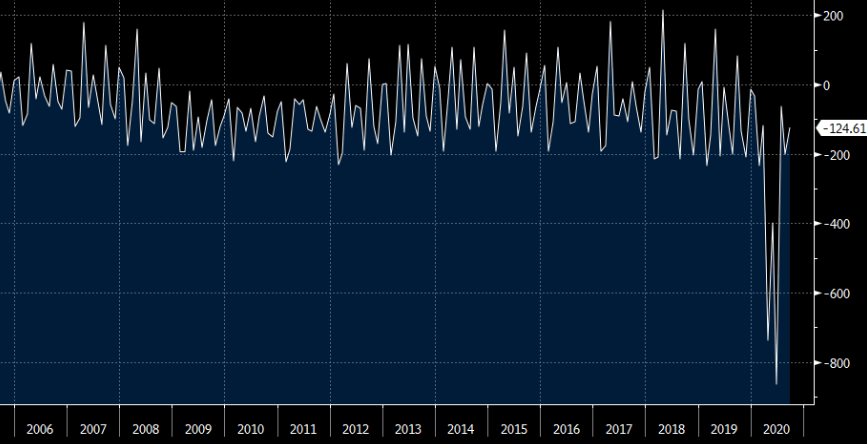

“The eurozone is at increased risk of falling into a double-dip downturn as a second wave of virus infections led to a renewed fall in business activity in October.

“The survey revealed a tale of two economies, with manufacturers enjoying the fastest growth since early-2018 as orders surged higher amid rising global demand, but intensifying COVID-19 restrictions took an increasing toll on the services sector, led by weakening demand in the hard-hit hospitality industry.

“The divergence is even starker by country. While Germany is buoyed by its manufacturing sector booming to a degree exceeded only twice in almost 25 years of survey history, the rest of the region has sunk into a deepening downturn.

“While the overall downturn remains only modest, and far slighter than seen during the second quarter, the prospect of a slide back into recession will exert greater pressure on the ECB to add more stimulus and for national governments to help cushion the impact of COVID-19 containment measures, which not only tightened across the region in October but look set to be stepped up further in November.”