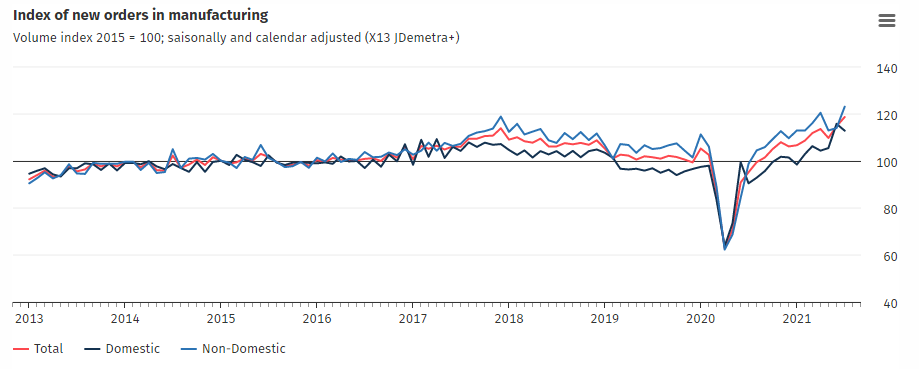

Remarks by the German economy ministry

- Q3 GDP growth to pick up significantly after 1.6% q/q growth in Q2

- GDP growth likely to normalise in Q4

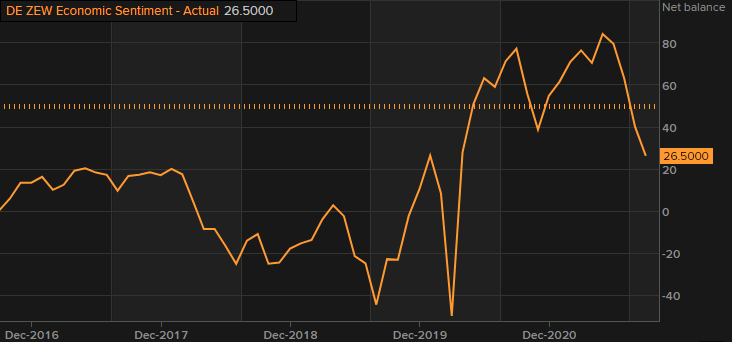

While there is an improvement to current conditions, the continued fall in the outlook is perhaps the more pertinent tell of economic sentiment at the moment. It reaffirms waning confidence as the summer ends and that growth expectations have peaked.

That’s a surprise jump after the solid bump in June, as new orders rise to its highest levels since the beginning of the survey all the way back to 1991.

Remarks from JP Morgan (speaking with Yahoo finance)

“Eurozone manufacturers reported another month of buoyant production in August, continuing the growth spurt into its fourteenth successive month. The overriding issue was again a lack of components, however, with suppliers either unable to produce enough parts or are facing a lack of shipping capacity to meet logistics demand.

“These supply issues were the primary cause of a shortfall of manufacturing production relative to orders of a magnitude not previously recorded by the survey, surpassing the 24-year record deficit seen in July.

“Factory selling prices consequently rose steeply once again, albeit with some of the upward pressure alleviated by a slight cooling of input cost inflation, albeit with still-high materials prices adding to manufacturers’ problems.

“Employment growth meanwhile eased only modestly from July’s all-time high as producers remained focused on boosting operating capacity. However, a dip in future sentiment in August – linked to the peaking of demand, persistent supply chain issues and the spread of Delta variant – add to signs that both output and employment growth has peaked.”

Recent results:

2245 GMT New Zealand Building Permits for July

2330 GMT Australia weekly consumer confidence

2330 GMT Japan Jobless (Unemployment) rate for July

Job to applicant ratio for July

2350 GMT Japan Industrial Production for July (preliminary)

0100 GMT China official PMIs for August, brief preview here: China PMI data for August due this week – what to expect

Manufacturing PMI:

Non-manufacturing PMI

0100 GMT New Zealand ANZ business survey for August

0130 GMT Australia Q2 Current Account, will include the “net exports as a % of GDP” for the quarter, this’ll feed into the GDP number due September 1.

0130 GMT Australia Private Sector Credit for