The positive tone continues

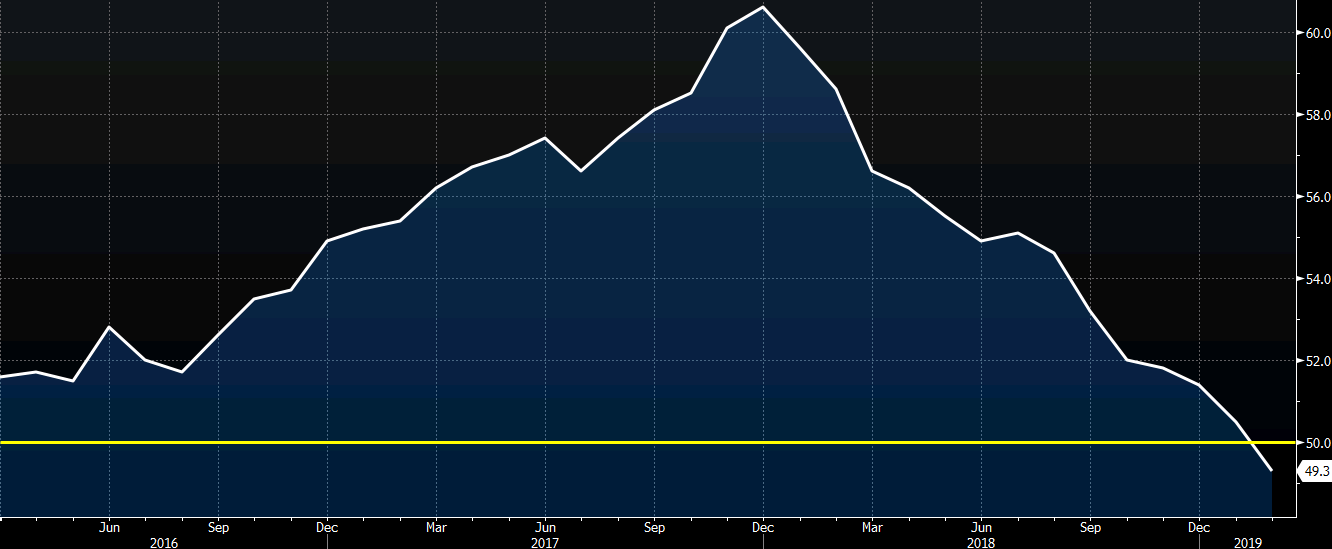

The preliminary reading can be found here. Only a mild improvement to initial estimates but more or less similar. The final reading here confirms that manufacturing activity in the region now sits in contraction territory and the print here sits at the lowest since June 2013.

More:

Marc Faber closed out this week’s Agora Financial Symposium with a speech that pretty much recapitulated the view that the end of the world is if not nigh, then surely tremendous dislocations to the existing socio-political and economic landscape are about to take place (with some very dire consequences for the US). His conclusive remarks pretty much summarize his sentiment best: “We’ve had a trend for most of the past 200 years: GDP of countries like China and India went down while the West surged. That’s now changed. Emerging economies will go up, and your children in the West will have a lower standard of living than you did. Absolutely. We won’t sink to the bottom of the sea. But other countries will grow much faster than us. The world is very competitive, and the odds are stacked against us. Americans, with their inborn arrogance, will not let it go that easily, so there will be lots of tension going forward.” While long-time fans of Faber will not be surprised by the gloom and doom (not much boom) here, anyone else who still holds a glimmer of hope that at the end of the day the CNBC spin may be right, is advised to steer clear of Faber’s most recent thoughts.

Marc Faber closed out this week’s Agora Financial Symposium with a speech that pretty much recapitulated the view that the end of the world is if not nigh, then surely tremendous dislocations to the existing socio-political and economic landscape are about to take place (with some very dire consequences for the US). His conclusive remarks pretty much summarize his sentiment best: “We’ve had a trend for most of the past 200 years: GDP of countries like China and India went down while the West surged. That’s now changed. Emerging economies will go up, and your children in the West will have a lower standard of living than you did. Absolutely. We won’t sink to the bottom of the sea. But other countries will grow much faster than us. The world is very competitive, and the odds are stacked against us. Americans, with their inborn arrogance, will not let it go that easily, so there will be lots of tension going forward.” While long-time fans of Faber will not be surprised by the gloom and doom (not much boom) here, anyone else who still holds a glimmer of hope that at the end of the day the CNBC spin may be right, is advised to steer clear of Faber’s most recent thoughts.

And while we do not have the full presentation yet, the salient points have been recreated below courtesy of the Motley Fool. For those who desire a far more in depth presentation from the inimitable Mr. Faber, we direct you to his June 2008 capstone presentation: “Where is the boom, and the doom” – link here.

On reality: My views are not all that negative. I think they’re just realistic. I want to face reality. You have people like Paul Krugman who thinks we should have another bubble to pull us out of this. He actually said that. But he said the same thing in 2001. And you know how that turned out.

On unintended consequences: The Fed doesn’t seem to have learned anything at all from its mistakes. Their current policy of cutting rates to zero is designed to create sustainable growth, but they’ve created larger and larger volatility in markets. There are many unintended consequences of their actions.

The oil bubble of 2008 is a good example. In 2008, the price of oil went ballistic, but the U.S. was already in a recession [it began in Dec. 2007]. There was no rational reason oil should have gone ballistic. The Fed’s easy money just fueled a bubble. It was like a $500 billion tax on consumers courtesy of the Fed. That’s the added amount that it cost you, and it helped push consumers over a cliff in late 2008.

On the Fed: The Fed doesn’t pay any attention to asset bubbles when they grow. That’s their official policy. But they flood the system with cash when bubbles burst. They only care about bubbles when they crash. It’s a very asymmetric response and it has many unintended consequences.

Letting bubbles inflate and then fighting them when they burst actually worked for a while. That’s what makes it dangerous. It worked in the ’90s. But you shouldn’t read too much into this: This period was assisted by unusually favorable conditions. From 1981 until early last decade, commodities were in a bear market after a bubble in the ’70s and early ’80s. And interest rates were falling throughout the ’80s and ’90s, too. They almost never stopped falling. That made Fed policy look like it was working.

Bubbles can still happen without expansionary monetary policy. In the 19th century, you had bubbles in railroads, for example. But today, the Fed has created a bubble in everything — in every single asset class. This is an achievement even for a central bank. Stocks. Commodities. Bonds. Real estate. Gold. Everything goes up when the Fed prints. The only asset that goes down is the U.S. dollar.

On deflation: I’m a believer that the stock market lows of March 2009 will not be revisited. You have people like Robert Prechter who think the Dow will collapse to 700 because of debt deleveraging. Debt deleveraging could happen, but the Dow will not fall because of monetary policy. The Fed will keep everything inflated in nominal terms. And if the Dow does go to 700, you’ll have more to worry about than your investments. All the banks will be bust. The government will be bust. You don’t want cash if massive deflation happens. On the contrary: It will be worthless. You have to think very carefully about hardcore deflation. (more…)

![]()

Greek 5 year cds at 725.4 bps vs 668.6 bps New York close Friday

Spain 5 year cds at 245.5 from 218.8 bps

Updated at 14:03/1st June/Baroda

The deal will also involve the International Monetary Fund and is expected to include 22 billion euros of funding for Greece, sources said.

The deal will also involve the International Monetary Fund and is expected to include 22 billion euros of funding for Greece, sources said.

It is now up to European Union President Herman Van Rompuy to call a summit of eurozone leaders possibly later tonight to consider the French-German deal, after talks attended by all 27 European Union heads of state.

The meeting would ask Van Rompuy to draw up detailed plans “before year end to show all the options possible” for bailing out eurozone nations in future. That would include preventive measures and sanctions, a diplomat said.

Spanish government spokeswoman Cristina Gallach said she could not confirm any deal but that Spain – which heads most European Union talks because it holds the EU’s rotating presidency – was “hopeful” that a solution could be found at the talks for Greece’s debt woes.