Oil under pressure

Oil is lower for the second day after Genscape reported that inventories at Cushing rose last week. API data is due late today and EIA data tomorrow.

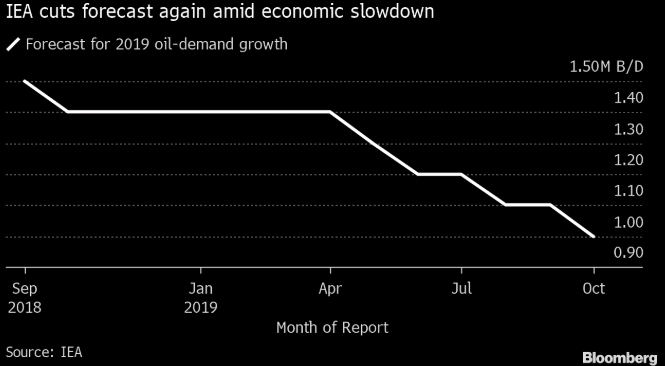

There is talk about swelling inventories globally along with modest demand growth. Along with that comes with speculation that OPEC may need to cut production further in December. That’s a longshot. Instead, OPEC may try to squeeze a few of the members that are overproducing into complying with quotas.

Technically, the rally in oil stalled right around the 50% retracement of the Saudi spike.

Meanwhile, forecasts for colder weather in the US continue to boost natural gas prices. The front month surged yesterday and is up another 4.5% today.

I highlighted an inverted head-and-shoulders pattern yesterday with a target of $2.60. We’re almost there.