IEA comments in its monthly report

- Iraq oil supply potentially vulnerable amid rising political risks in the region

- US-Iran tensions and Iraqi protests had only minimal impact on oil operations

- But fragile situation may limit Iraq’s plans to expand oil production capacity

- That may make it difficult for global industry to meet rising long-term demand

For some context, Iraq is the second largest oil producer in the Middle East and pumped 4.59 million bpd of oil in December. That said, the OPEC+ pact still requires them to cut around 130k bpd to meet the compliance quota.

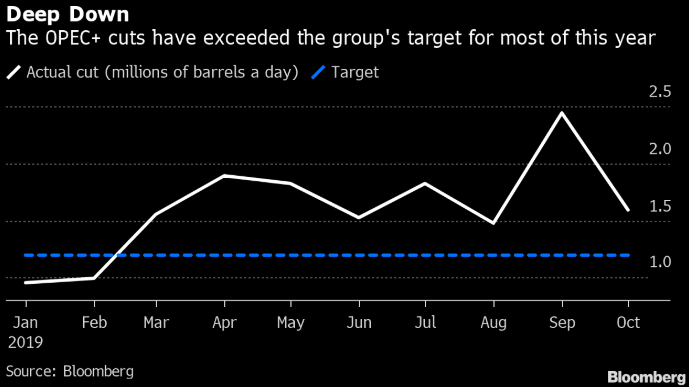

However, even with Iraq and all of OPEC+ reaching full compliance, IEA forecasts that the world market still faces a surplus of about 800k bpd in 1H 2020.

That kind of landscape makes it a tough situation to see oil prices significantly higher this year and could suggest that we have already seen the highs for the year amid US-Iran tensions over the past two weeks.