A Vitol executive speaking over the weekend, said that the 400K barrel per month (through to the end of this year) increase in supply being proposed by OPEC+ is insufficient to hold prices from rising.

- “There is very little doubt, that whatever OPEC agrees by way of lessening of the cutbacks it will surely …. be a fraction of that amount needed to meet demand,”

- “OPEC are in a big chunk of the way towards their stated objective of getting the global inventory overhang back to manageable levels from their perspective, which is basically 2019 norm and we still have a market which has an outlook which for the spot months there is going to be more demand than supply.”

—

I posted earlier, and over the weekend on the continuation of OPEC+ talks scheduled for today, Monday.

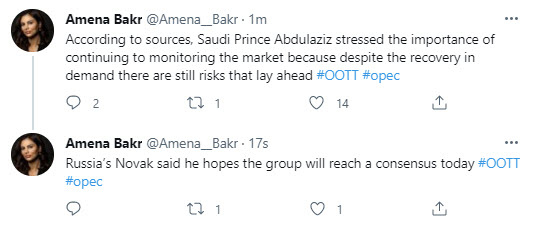

- Saudi energy minister comments ahead of Monday’s continued OPEC talks

- Heads up weekend news – OPEC+ talks will resume on Monday

Long story short is that the OPEC+ coalition proposes to

- bump its collective crude output by 400,000 b/d each month from August to December

- and extend their supply management agreement through the end of 2022

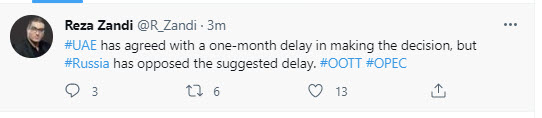

However, the UAE wants its output allowance raised and has not yet agreed to the proposals.

—

Vitol is the world’s largest independent oil trader.

The price of crude oil reach day high price of $76.20 earlier after breaking above the earlier high at $74.42 and squeezing any shorts ahead of the OPEC+ meeting.

The price of crude oil reach day high price of $76.20 earlier after breaking above the earlier high at $74.42 and squeezing any shorts ahead of the OPEC+ meeting.