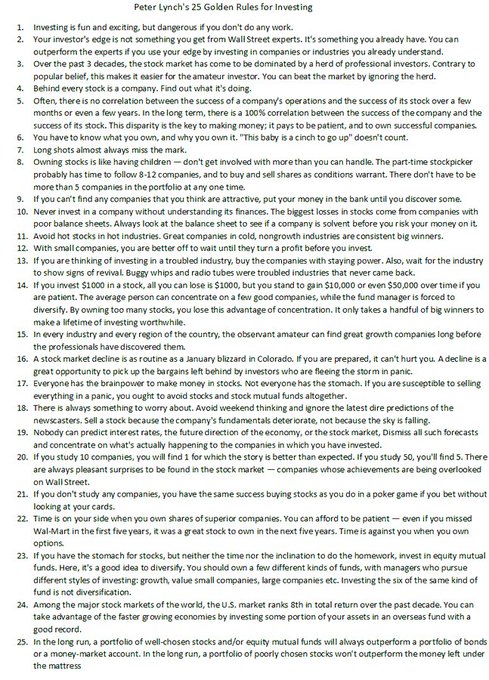

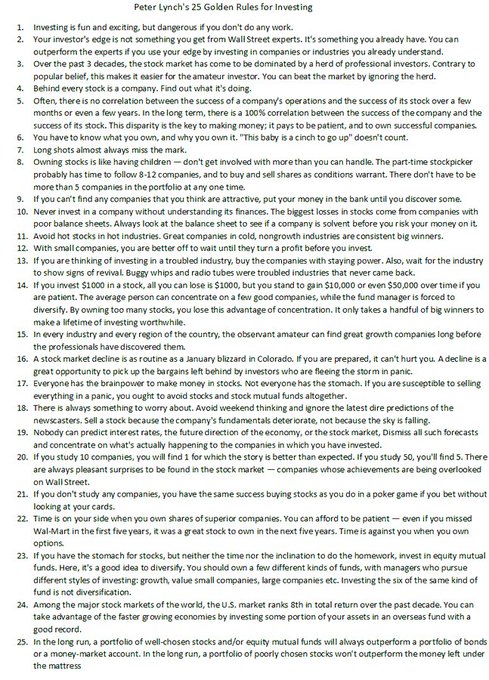

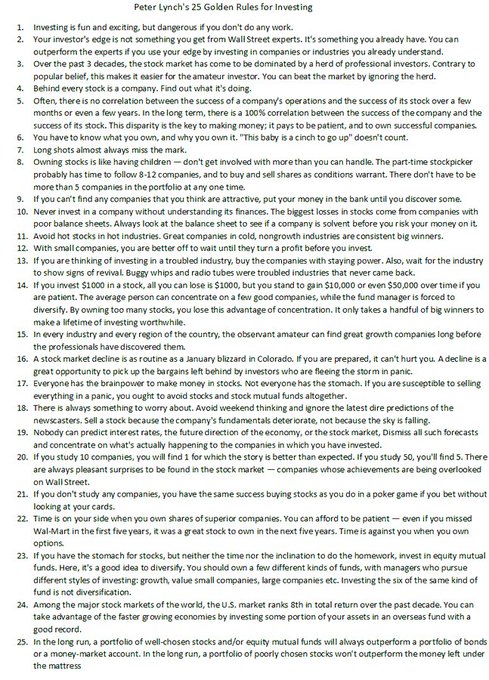

25 Golden Rules by Peter Lynch

The pound may have recovered well after its crash on Monday but the heightened volatility isn’t exactly a good sign for the currency itself, as it is arguably a sign that traders are shouting for more credible policy between the central bank and the government. The dollar is little changed so far today after backing away from its highs in the past two days, with month-end and quarter-end trading also in focus. The swings are likely to continue today so that will make it tricky to interpret things until we get to next week.

All eyes will stay on the bond market as a signal for broader market sentiment but as mentioned above, there might be mixed flows taking place with month-end and quarter-end rebalancing also something to consider. The technicals are your best friend in these sorts of situation, so that will at least help provide some guidance amid the recent bout of volatility ahead of the weekend.

A couple of notes for traders on some time and date events coming.

It is true that you may not become wealthy in the next couple of months or years if you just began. However, if you maintain the proper mindset and attitude, you will eventually see a piece of that success.

It is true that you may not become wealthy in the next couple of months or years if you just began. However, if you maintain the proper mindset and attitude, you will eventually see a piece of that success.

Having patience is all about trading.

It is unfortunate but true that you will not become wealthy immediately, or even in the next few years if you are just beginning. However, if you maintain the proper mindset and attitude, you will eventually see a portion of that accomplishment.

BlackRock lead off their view on equities with this. Its about as blunt as you’ll get from analysts:

More detail from the asset management firm:

World Bank president Malpass

I can’t see anything controversial or even new in those remarks.