Economist Campbell Harvey wrote his PhD dissertation at the University of Chicago decades ago on the shape of the bond yield curve being linked to the path of US economic activity.

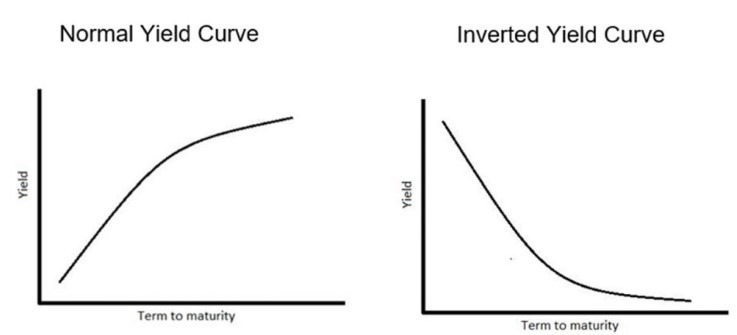

i.e. That US recessions have been preceded by an inverted yield curve

- hich is when short-term rates exceed those of longer term rates (this is the gist of it)

This time though…

- “My yield-curve indicator has gone code red, and it’s 8 for 8 in forecasting recessions since 1968 — with no false alarms,”

- “I have reasons to believe, however, that it is flashing a false signal.”

Harvey outlines his reasoning here at the article.

—

Harvey was speaking in an interview on Tuesday.

Harvey is a professor at Duke University’s Fuqua School of Business.