Here are some tactics for improving self-control and discipline while trading:

- Develop a trading plan: This includes having a defined strategy, setting clear goals, and having a plan for risk management. Having a plan can help you avoid impulsive decisions and stay focused on your objectives.

- Practice patience: Avoid the temptation to jump into a trade too quickly or close a trade prematurely. Take your time to analyze the market and wait for the right opportunity.

- Avoid emotions: Emotions such as fear and greed can cloud your judgment and lead to poor trading decisions. It’s important to stay level-headed and make decisions based on your trading plan and market analysis.

- Keep a trading journal: Record your trades and reflect on what worked well and what didn’t. This can help you identify patterns in your behavior and identify areas where you need to improve your self-control and discipline.

- Take breaks: Taking breaks from trading can help you avoid burnout and reduce the risk of making impulsive decisions.

- Seek help: If you find that you struggle with self-control and discipline in your trading, consider seeking help from a mentor or coach. They can provide you with guidance and support as you work to improve your skills.

- Stick to your plan: Finally, it’s important to stick to your trading plan, even when things aren’t going well. This can be challenging, but it’s essential for developing discipline and self-control as a trader.

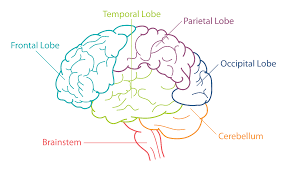

The brain plays a critical role in trading performance, as our thoughts, emotions, and behaviors can all impact our decision-making and ability to execute a trading strategy effectively.

The brain plays a critical role in trading performance, as our thoughts, emotions, and behaviors can all impact our decision-making and ability to execute a trading strategy effectively.