The ECB may soon have different problem than fighting inflation

On the week:

Even with the best day in months, the weekly candle in the CAC still doesn’t cover last week’s decline.

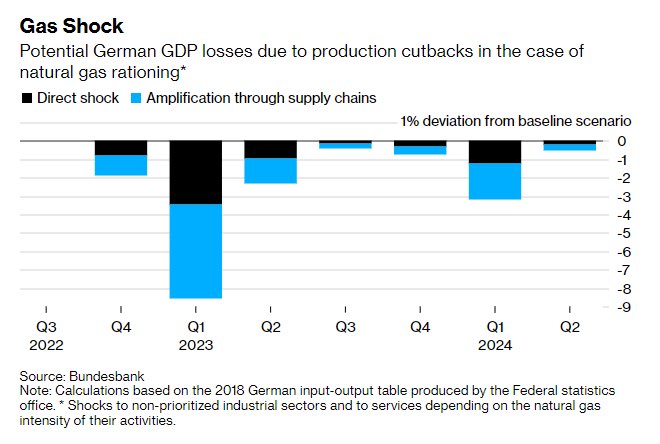

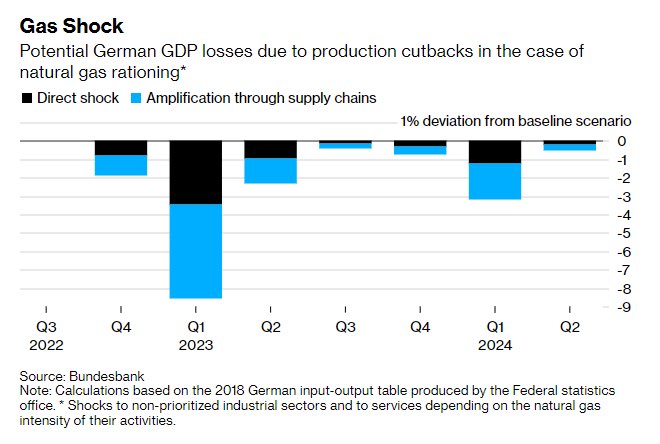

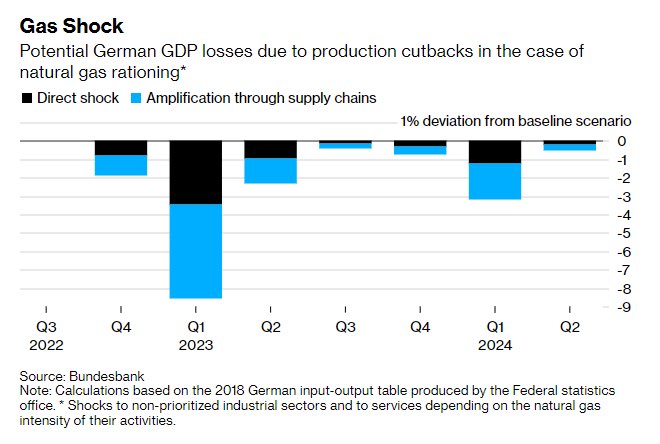

It will be a bit naive to completely rule out a recession at this stage. The combination of higher and more persistent inflation as well as the gas supply shortage will present major economic headwinds to Germany in the months ahead. If the former doesn’t ease significantly, I doubt things on the ground will see a turn for the better.

More at that link to DJ/MW above.

This via AP overnight on news that on Thursday the German government has activated the second phase of its three-stage emergency plan for natural gas supplies

Follows Russia reducing energy deliveries to several countries

Industrial customers are being asked to reduce the amount of natural gas they use

This does not auger well for German industrial production.

Gas prices have come off the boil: